A new modern payment system, Samsung Pay, has launched in Russia, the main focus of which is working with mobile phones and smartphones. In Russian it sounds like Samsung Pay and, as you probably already guessed, its author and developer is a South Korean company. Today, the user base of the service has already exceeded 1 million people!

Now your phone is your electronic wallet. Simple, fast, convenient!

What is her “trick”? In simple words, the peculiarity of this function is that thanks to it you can not carry a credit card with you, but simply bring your mobile phone to the terminal and pay with it.

What is Samsung Pay?

The service is electronic payments made through the company’s mobile devices. Most smartphones and tablets support this option.

The service appeared in August 2015, after the Korean manufacturer bought the small company LoopPay in February.

She developed and implemented a new opportunity for the banking industry. The novelty is as follows.

The program creates a virtual magnetic stripe, which is used on electronic payment instruments when paying at the terminal.

The technology is called Magnetic Secure Transmission (MST). It creates an emulation of a magnetic field, as a result of which the terminal accepts this virtual field as a magnetic stripe and performs a read operation.

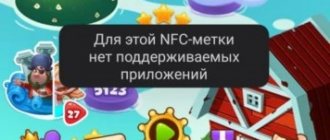

MST is completely connected to another NFC technology. Translated from English it means “near field communication”. It appeared in 2004, but has not yet received proper distribution.

Thanks to the Samsung Pay service, NFC has become more popular, since contactless payment only works when NFC is turned on. The range is no more than 8 centimeters, which is the optimal value for paying from your phone.

Important! To launch Samsung Pay on a mobile device, the user needs to swipe up on the communicator’s sensor.

After the option began to be actively used in the Russian Federation, the vendor organized an advertising campaign in support of its new technology.

Many services and goods were much cheaper when paid through Samsung Pay.

For example, travel on the Moscow metro was two times cheaper if the client paid through contactless payment technology.

Which phones support Samsung Pay?

The contactless payment function is not supported by all Samsung smartphones. Earlier versions do not have this feature.

The list of the most popular models is as follows:

- Galaxy S8;

- Galaxy S7;

- Galaxy S6, but there are some limitations;

- Galaxy A3;

- Galaxy S9;

- Galaxy A5.

The S6 series does not have built-in MST technology, which means that models in this category can only work with modern electronic payment devices.

Is it possible to install Samsung Pay on another phone?

If you have a mobile device from another manufacturer, then you won’t be able to use Samsung Pay directly. Don't be upset, there is a way out:

- Buy a smartwatch from Samsung.

- Launch the application on your Samsung Gear smartphone.

- In the settings section you will see the Samsung Pay item.

- Add a new card, specifying its characteristics and details.

- Wait for both devices to sync.

- Done, now you can use the contactless payment service using any Android phone.

There is only one requirement: the smartphone software must be at least Android 4.4.

How is Samsung Pay useful?

The service is convenient because you can pay by bank transfer using only your smartphone.

Phone owners no longer have to look for a bank card to pay through the terminal. You just need to activate the application and make a payment. The actions will take no more than one minute.

This service will save time on purchases; you will no longer have to stand in lines waiting for sellers to find change for the buyer. Payment occurs instantly.

There is a function to save payments. All financial transactions made using Samsung Pay are saved in the application.

At any time, the owner of the communicator can open the history and track the purchase history.

The application can store an unlimited number of payment cards. Thus, the client can load all his cards into the program and no longer carry them with him.

How it works in theory

Payment is very simple. To pay, just open the application by swiping up and bring your phone to the bank terminal, confirming the purchase. All user data is stored in encrypted form, and information about virtual cards is transmitted to the terminal, which allows you to keep real data safe. No commission is charged.

Technology safety

When using Samsung Pay technology, many smartphone owners have a question: “How safe is it to use such a function?”

The Korean vendor has established the following three rules that will help protect data during payment and prevent attackers from gaining access:

- Tokenization. During a payment transaction, a one-time security token is received from the mobile device, which can only be accepted by one terminal. It is generated randomly. Its main purpose is to hide the bank card code; all data inside it is encrypted. Thus, the transfer of payment details to the terminal is completely encrypted and eliminates the possibility of hacking;

- KNOX. Special technology that was developed by Samsung to protect its data. The technology is a “sandbox”, that is, it is an isolated virtual space in which all financial transactions or any other user actions take place. Using KNOX allows you to reliably protect the data of smartphone owners from intruders;

- Confirmation of debiting funds from a payment instrument is carried out either by fingerprint or through a PIN code. The restriction only applies when paying over 1000 rubles. Accordingly, funds will not be written off without the user’s permission.

Important! Contactless payment technology does not work on rooted mobile devices. This is because communicators with full access rights are not reliable in terms of using Samsung Pay.

Unique data protection methods in Samsung Pay

“Tokenization” of data is the first circle of protection of user data. The essence of the method is to replace real user data (numbers, full name of the owner, etc.) with virtual ones. When a card is activated in Samsung Pay on the user’s smartphone, the real card number is replaced with an encrypted digital code - a “token”, which is generated randomly.

The KNOX protected environment is the second circle of protection, which is an entire security system. This reliably protects the smartphone from possible attacks by various malware and constantly monitors potential threats to user data.

Even if a spyware virus gets onto the device, user data will remain securely encrypted in a protected “container” inside KNOX. Before registration, the security system checks the current firmware of the device.

If the smartphone is hacked, for example, attacked by viruses or an unofficial firmware version is installed on the device, the user will not be able to register a credit card. If the smartphone is hacked by the user himself to grant administrator rights - Root rights, the KNOX security system will block the Samsung Pay service and its use will be impossible even after re-flashing the device and removing Root rights.

Authorization using a fingerprint or PIN code is the third and final layer of protection. To pay for each specific purchase using the service, mandatory user authorization using a fingerprint or a unique PIN code is used.

Even if your smartphone falls into the hands of criminals, they will not be able to pay for goods via Samsung Pay without the fingerprint of the device owner or a PIN code that is known only to you.

How to download the application?

program from the official website using the following link.

On the page there is a button “Download Samsung Pay” - click it.

Download the application from the official website

Important! You must access the link from a Samsung mobile device. Otherwise, the user will not be able to download the application.

A link is also available in the official online store of the manufacturer of the Android operating system.

Click “Install” and wait for the download process to complete.

How to register in the application?

After the application has been installed on the mobile device, launch it and go through registration. There are two possible options. The first case is when the client already has an account on the Samsung domain, and the second is when the user purchased a mobile device from a Korean company for the first time.

Let's first look at how to create an account name on the Samsung portal. If the smartphone owner already has it, move on to the next point.

- On your mobile device, open the “Settings” menu and go to the “Accounts” section. Next, click “Add account”;

Accounts section

- In the window that opens, select the line as shown in the screenshot below;

Selecting a Samsung account

- In the window that opens, select “Create an account”;

Account creation menu

Important! If the smartphone owner has problems registering, he can go to the “Help” section located in the lower right corner. It contains brief instructions on what data to provide and where to go next to register.

- The main window with registration information will be displayed on the communicator screen. Let's start filling it out as follows.

New user registration form

First, the client comes up with an account name. It can be arbitrary, the main thing is that it is easy to remember and unique.

In the next two lines, enter the password and its confirmation. It should be invented according to the recommendations below.

Important! The password must contain at least eight characters. It must contain at least one capital letter, a special character and a number. It is recommended to enter characters on the Latin keyboard layout.

To check the entered data, the user can activate the “Show password” option. The data specified in the corresponding fields will be displayed on the screen.

Next, fill in the information about the year of birth and indicate the full name of the phone owner. This information is necessary so that if the mobile device is lost, the owner can get it back.

As an alternative account, he suggests using a name on the social network Facebook.

After the account has been registered in the Samsung system, you can activate the Samsung Pay application.

- Open Samsung Pay and enter your account name in the Samsung system;

- In the window that opens, create a password. If your smartphone is equipped with a fingerprint sensor, it is recommended to set your fingerprint as the main password;

Set a fingerprint for entry

- After this, the phone owner will see the main screen of the program. Now you need to add an electronic means of payment to it;

Main screen of the mobile application

- Click “Add”. A new window will open in which the client specifies the payment instrument details for payment;

Form for filling out details

The user indicates the bank card number, its expiration date - month and year, as well as the last name and first name of the card owner. After that, click “Pay” to verify the specified data. A small amount of money will be debited from the payment instrument, which will be returned within 5-8 minutes.

You can also automatically download the details of an electronic payment instrument. To do this, the owner of the mobile device takes a photo of the card from both sides and waits for the application to recognize the data on the card.

An alternative verification method is to receive an SMS with a one-time code to the client’s mobile phone number. He enters it into a special verification field.

- If the check was completed correctly, the following message will be displayed on the screen.

Successful card registration confirmation window

Now the user can add an unlimited number of cards.

Important! Only cards that support Samsung Pay . These include payment instruments that have a built-in PayPass or PayWave function. The card will have a special sticker indicating contactless payment technology.

Bank card supporting contactless payment function

How to install Samsung Pay on your phone

There is no need to install or download the application; it is automatically included in the startup software in every original smartphone from the manufacturer, but there are exceptions. In this case, you can download the utility on the official Samsung portal or in any online software store. The program itself does not charge money for use and is provided free of charge. After downloading, the installation process will automatically start. Next, you will need to configure the mobile application for correct operation:

- In the main menu, the system will ask you to log in to the Samsung Account service; if an account has not been created, you will have to register it.

- After this, in the main window, select the security section to set consumer identification parameters.

- Select the authorization method – fingerprint.

- Now you need to register your unique skin pattern. Place your finger on the scanner and wait until the system recognizes it and adds the fingerprint to memory.

- If you do not want to use a fingerprint, select confirmation with a pattern or numeric password.

- This completes the application setup. The last step is to attach a bank card.

To attach a credit card, it is important to consider that the bank that issued it is one of the partners of the service developer, otherwise it cannot be attached to the utility. To connect the plastic, follow the instructions:

- Launch the program.

- In the main window there is a button for registering a new card, click on it.

- Enter your bank details – number, user name and credit card expiration date. To avoid wasting time and filling out fields manually, scan it using your smartphone’s external camera. The information will automatically appear on the display.

- Please review the user agreement and read it carefully. If everything is satisfactory, confirm it.

- Go through identification. A notification will be sent to your mobile phone with a security code, which must be entered in the appropriate field of the application.

- Draw your signature with your finger or stylus.

- Save your changes. To add further cards, repeat the algorithm.

The functionality of the utility does not end there; you can attach a discount or discount card from a partner company to the service. To do this, just select the appropriate item in the main window and scan the barcode on the back of the plastic using the camera.

Virtual card

You can also register a virtual card in the Samsung Pay software. The registration principle is similar to the process for standard bank cards, but there are some differences.

Firstly, the payment instrument details are generated by the vendor, without user participation. This guarantees a high level of reliability of the generated data.

Secondly , the maintenance of such a card is completely outsourced. That is, the user no longer needs to change it or contact representatives of the financial institution in case of any problems.

Thirdly, a virtual payment instrument will allow the client to secure their payments on the global network. If he suspects that he has been hacked, just go to the Samsung Pay program and block the current virtual card.

Which banks support Samsung Pay?

Most financial institutions are ready to work with Samsung pay technology. From their point of view, this is a new technology that will completely replace the standard payment method in the near future.

List of famous banks:

- SberBank;

- Alfa Bank;

- Gazprombank;

- Tinkoff;

- VTB 24;

- Rocketbank;

- Russian standard.

I would also like to mention the Sberbank MIR payment card. This is a new system that was developed in Russia. Mainly used by government agencies.

In 2022, it was decided to launch a pilot project, in which several banks from the list above participated. They introduced the ability to use the MIR payment system for contactless payment via Samsung Pay.

After successful testing, the project was approved, and in 2022 the service became widespread. Today, most banks work with the MIR payment system in the same way as with others. Bank card holders can safely pay for purchases.

What cards are supported?

To use the service, you need to add your card; you will find instructions below. Only certain bank cards are supported:

Please note that only MasterCard payment system cards are supported. It is expected that Visa cards will also be connected to the system in 2017. You can connect up to 10 different bank cards to one smartphone. One card can be connected to the number of devices allowed by the rules of your bank. For example, at Sberbank one card can be linked to only one device.

The service does not allow you to withdraw money from an ATM. But it allows you to cash out in Europe at the checkout if the store states that it can make change from bank cards. This doesn’t happen often, but it does happen, and it allows you to cash out money from a card on your phone. Remember that your phone is a complete analogue of your card.

How to use Samsung Pay?

Here are a few instructions on how to pay using the contactless payment system.

- The client approaches the store’s cash register and waits while the employee enters payment information into the terminal;

- After the cashier announces the total purchase amount, the smartphone owner swipes his index finger across the screen from bottom to top to activate the Samsung pay application;

- In the next step, the user brings the mobile device to the payment terminal and waits until a message appears on the screen confirming the payment transaction;

- The client puts the communicator in his pocket and takes the purchase.

How to use Samsung Pay

Samsung Pay is a modern and convenient method of contactless payments. With its help, the user can pay for a purchase in any store where an appropriate payment terminal is installed and bank cards are accepted. The main advantage of such a service is that NFC technology is used, as well as MST. Thanks to this symbiosis, the subscriber has the opportunity to make payment transactions even with terminals that read the magnetic stripes of a credit card.

Samsung has created its own technology with which a mobile device generates an individual magnetic field that imitates a simple bank card. This means that with one mobile phone in their pocket, a consumer can complete any purchase without incurring additional fees. This opportunity appeared on the Russian market relatively recently, so many sellers do not believe that payment can be made using a cell phone.

Paying by phone is quite simple; to do this you need to perform a number of simple operations:

- Purchase a mobile device that supports this feature.

- Add your virtual card to the application.

- Select the desired credit card from the list of previously added ones. This can be done in the main utility in the corresponding tab or from the favorites list. Opens after sliding your finger from bottom to top across the smartphone screen. To configure the list of favorite cards, go to your phone settings. Here you can adjust the features of displaying credit cards on the main screen, as well as add the ones you need to the list.

- To pass authorization, to do this, enter a security password or scan your fingerprint and bring the device to the payment terminal.

- After this, you have thirty seconds to complete the payment. After 20 seconds, the repeat icon will appear on the display. If you press it, the waiting time will increase by another 20 seconds.

- Ready. Expect a check from the terminal. The operation will be successful only if there are funds in the bank account.

Why doesn't Samsung Pay work?

During the payment process, various nuances are possible. Here are some of them.

- If the total amount is over 1000 rubles, the user will have to confirm the payment: place a finger on the sensor on the phone or enter a PIN code;

- At times, terminals lose contact with the financial structure, which results in a delay in payment confirmation or refusal by banks. In such cases, it is recommended to try making the payment again after a couple of minutes;

- There are insufficient funds on the linked card. In this case, it is first recommended to check the client’s current balance. And then try to use other cards, since by default in the settings of the Samsung Pay application only one card is used;

- The client did not purchase the phone from authorized Samsung partners. That is, he purchased a “gray” mobile device. In such situations, when registering in the Samsung system, the user will receive a message stating that the smartphone does not support the contactless payment option;

- The firmware of each phone needs periodic updates, which contain the necessary data. It is recommended to regularly update the operating system and applications used to maintain relevance and new features;

- From time to time, the NFC adapter stops working properly. You just need to restart your mobile device to check its status. If it still does not work, then it is recommended to contact an authorized service center to resolve the problem.

Important! It is best to correct any physical damage to a mobile device not on your own, but through authorized service centers. They are available in many cities of Russia.

What is Samsung Pay

Samsung Pay is a universal and simple technology that allows the owner to make contactless payments. With its help, the consumer can buy goods in any store where the appropriate payment terminal is installed. Nowadays, such equipment is available in almost every establishment, with the only exception being remote regions of Russia. The operating principle of the service is to use special NFC and MST microchips.

They are able to imitate a signal from a bank card at a short distance, which contributes to a high level of security. Even if the seller has an outdated reader that only accepts credit cards with a magnetic stripe. The MST module creates a magnetic field around the mobile device, like a credit card.

As a result, the terminal receives the signal and makes a calculation. Despite this, many sellers still do not believe in such technologies and are skeptical about this method of paying for goods. This combination of two modules sets Samsung Pay apart from other analogues and competitive services and puts it in first place, because with the help of a smartphone you can make a purchase anywhere.

Therefore, the application has many advantages:

- Easy to use. To work, you do not need to install special options or configure them additionally.

- High data exchange speed. Information is transferred from the transmitter to the reader on the terminal and the connection is established in a matter of seconds. You no longer need to wait for change from the seller, which eliminates queues in stores.

- Ease of use. All you need is to have a mobile device in your pocket.

- Transaction security. The developer provides the maximum level of protection of personal data. The exchange of information takes place at a minimum distance and within a few seconds, this leaves no chance for fraudsters to intercept the details. No one except the owner of the smartphone will be able to make a payment, because a fingerprint must be scanned as confirmation of payment. If the total amount exceeds 1000 rubles, then you need to confirm the payment again by entering a security PIN code on the terminal itself. Information about bank cards is stored on a separate chip, which is not tied to any application, which prevents infection by virus programs. And if you lose your smartphone, you can use a special utility to block it remotely and not lose money.

Samsung service centers

Information about service centers can be obtained on the company’s official website.

By going to the site, the visitor indicates his device with which he has a problem.

List of Samsung devices

Next, he selects the option he needs and clicks on it with the left mouse button. A list of mobile devices will be displayed on the screen.

List of service centers in Moscow

The search uses special filters. The visitor can choose which service centers he is interested in: direct from, partner authorized centers, or both options.

Detailed information is provided for each company. Worth a five star rating. The more stars, the more clients liked the service center.

Below is the official address of the portal and contact phone numbers for additional information. Some service centers have recommended visiting hours.

Loading time for the service center during the working day

At the very end of the line there are two links. When you click on the first one, the client will be shown the location of the service center on a schematic map, and the second one will help get directions using the Yandex.Maps service.

Samsung support

If a user has problems with a mobile device or Samsung Pay technology, he can contact the vendor’s contact center.

The hotline is available at 8-800-555-55-55 and is free for all residents of the country. Opening hours from seven in the morning until ten o'clock in the evening, Moscow time.

The subscriber dials the number and tells about his problem. If a contact center employee can resolve his issue, then he is trying to help the client. For example, advise on how points are awarded for “Gold” status when purchasing through Samsung pay.

If the issue cannot be resolved immediately, the subscriber is directed to the next support line. The company's employees are highly qualified specialists and always try to help users solve the current problem.

You can also contact the contact center in other ways. Let's talk about each in more detail. There is a link to the chat on the vendor's official website.

Chat with the call center.

The user clicks “Start Chat”. A new workspace will open in which you need to fill in the following lines

Registration window

The client enters the name that will be displayed in the chat in the “Nickname” field. The following two fields are optional, but they can speed up the response in case of a problem with a technical device. It is recommended to specify parameters.

After this, the user accepts the agreement and clicks “Start”. He will have access to an online dialogue with a support employee.

The second way to contact the call center is by email.

Email to contact support

When you click on “Write a letter,” the visitor is sent to the site with a choice of one of two categories: general or technical. After activating one of the options, the user gets access to the form for sending a letter through the vendor’s website.

Form for sending e-mail

The client specifies the request type and then enters their name. As a means of feedback, you must indicate an e-mail and contact phone number.

Important! For corporate clients, it is recommended to check the appropriate box. In this case, the response will be sent to your corporate email.

The second part assumes that the client provides detailed information about the problem that occurred.

Detailed information form

The top field serves as the title of the letter, and in the message the user tells about the problem that happened. If the client needs to upload screenshots, then they should use the appropriate field below.

After this, the user optionally confirms his consent in the fields below and clicks “Submit”.

The answer will come within a few days. If necessary, the client will be contacted at the specified phone number.

Samsung also has accounts on social networks.

Social network profiles

The user follows the link and asks his question in private messages. Operators are almost constantly online and are ready to provide a detailed answer to the question asked.

Samsung Rewards

The Korean vendor has introduced a program for all technology owners. When paying through Samsung pay, customers receive additional points, which depend on the purchase amount. After accrual, they can later be spent through the Samsung online store.

The program is called Samsung rewards, and it works according to the following principle. For each amount spent, the client is awarded points. The minimum value is 10 points. Next, the number of points received is multiplied by the user coefficient, which depends on the client’s status.

Initially, each new user has the “Beginner” status.

If a smartphone owner constantly uses contactless payment technology and makes at least five purchases a month through Samsung Pay, then the coefficient increases from one to two. Now the user receives “silver” status.

Points accrual scheme depending on client status

As you can see from the screenshot above, to get the next level as a mobile device owner, you need to make at least twenty purchases per month.

And to obtain the highest Platinum status – 30 operations.

In order for the status to remain up to date, purchases must be made monthly; as soon as the user stops using Sasmung pay, his status is reset.

It is also worth noting the additional promotional programs offered by partners. For example, when using the Samsung Pay service with a linked Moscow Credit Bank card, the smartphone owner receives a cashback of 10% of the amount spent.

Another option for promotional programs is a permanent discount on goods or services when paying through Samsung Pay.

More details about all current promotions can be found on the company’s official website.

It is recommended to constantly check the company’s mobile application or portal to stay up to date with current promotions or advantageous offers.

Sometimes after an update, the Samsung rewards service disappears in the Samsung Pay application. In such cases, you should go to the program settings, the “Help” section, then “Adding a Rewards card”.

The application will automatically contact the vendor’s cloud storage and scan the user’s data again.

Advantages

Here are the positive aspects of using Samsung Pay compared to other similar services:

- Samsung has developed this technology to support not only bank cards with a chip, but also older generation payment instruments with a magnetic stripe. MSD technology generates a virtual field identical to the magnetic one, causing the terminal to accept it;

- A unique development called KNOX is a virtual isolated space that can protect the user when using Samsung Pay. This technology conducts all financial transactions in its own environment, and if there is a suspicion of hacking by an attacker, it simply blocks access to other functions of the smartphone;

- When using contactless payment technology, smartphone owners receive bonus points in partner stores or from participants in promotional programs. Accumulated bonuses can be spent in the official Samsung store;

How does the system work?

Before paying for the goods, warn the cashier that you will pay using a bank card, then swipe your finger across the display of your mobile device from bottom to top to automatically launch the payment application, preparing it for work.

After launching the program, go through the authorization process by scanning the retina, finger papillary pattern, or entering a PIN code. After this, bring your mobile phone to the scanning element of the payment terminal.

If contactless transfers are carried out using NFC technology, the smartphone is brought closer to the top of the device. When activating the MST function, bring the phone closer to the place where you swipe your bank card.

The terminal will record the transaction using the Samsung Pay framework application, and a corresponding notification will be sent to your phone.

Reviews about the Samsung Pay service

Take the opinions of mobile device owners about the contactless payment service from the Otzovik website.

- User kornei considers this service very convenient and innovative. He filled it with all available bank cards and no longer carries them with him. The client uses a Galaxy S7 smartphone, which fully supports contactless payment, without restrictions. Samsung Pay only started working after all the latest updates for the phone. The user considers the only drawback to be the inability to support all types of cards;

- Client zxcvbn381 first used the contactless payment service in 2022. Since then he has been actively using it. He likes the level of security that Samsung has built into its app. Using the program saved the client from having to carry multiple bank cards. The only negative is constant advertising that cannot be turned off, but he hopes that they will stop inserting it into the application in the near future;

- User Anonymous1484453 previously used the Apple Pay payment system, but after purchasing a new phone, he switched to Samsung Pay. He is happy with everything, since, in his opinion, these are two identical technologies in the same design. But there is one exception: compared to Apple, Samsung Pay is slower.

What devices support

Please note that this system is not supported on all mobile devices. Contactless payment using Samsung Pay is available on the following smartphone models:

- Product line from the S series, from the S6 to S9 plus phone. But the S6 only has an NFC module, which means magnetic tape is not available.

- Devices from the A family, from A5 from 2016 to A6 from 2017.

- Galaxy Note fifth and eighth models.

- Smartphones marked J5 and J7, not earlier than 2022.

- Smart watches Gear Sport and Gear S#3.

Unfortunately, other models from the manufacturer, cheaper and simpler ones, do not support this type of contactless transaction. Therefore, read the user manual carefully before purchasing a smartphone.