Advantages and disadvantages of paying with a smartphone

Advantages of paying with a smartphone:

- Save time. There is no need to count out bills, insert a bank card into the receiver and enter a PIN code. The data arrives at the bank in 2-3 seconds.

- High level of security. An attacker can steal a bank card or cash, but you won’t be able to use an electronic card saved in a smartphone without access to the owner.

- Increasing the service life of a bank card. The physical payment medium no longer needs to be carried with you at all times, which means that the risk of damage, loss or theft is reduced to zero.

There are also disadvantages to paying using a smartphone:

- If you exceed the set limit, you will need to enter a PIN code.

- It is necessary to monitor the battery charge of your smartphone.

- An NFC-enabled smartphone is required.

What cards can be linked?

Not all banks in the Russian Federation support Android Pay; there is a list of participants on the Google Pay website. It is possible to connect cards:

- Sberbank;

- Yumoney (formerly Yandex.Money);

- VTB 24;

- Tinkoff;

- Alfa Bank;

- Dot;

- Raiffeisen;

- AK Bars;

- Opening;

- Russian standard;

- Rocketbank;

- MTS Bank;

- Binbank;

- Promsvyazbank and others.

Each banking institution has its own conditions for working with Android Pay for VISA and Mastercard cards. They should be clarified with the support service or office.

If the desired financial institution is not on the list, you can leave a request. Google will send a notification once the desired issuer appears among the number of partners.

Which smartphones support contactless payment?

To make contactless payments, a physical NFC module must be installed on your smartphone. Android smartphones must also support HCE. This technology is available on all modern smartphones older than 2014.

You can find out whether your smartphone has NFC in the settings. For example, on Samsung smartphones the contactless payment module icon is located in the quick settings menu.

Many banks have their own applications for contactless payments. One of these programs can be installed on a smartphone to quickly add bank card numbers to the appropriate software. But even without a program from a bank, a bank card can be added to third-party software that supports contactless payment.

How to link a card?

- Click “Add card”.

- You need to scan or enter the information manually in the proposed window. When scanning, you do not need to enter the number and expiration date. However, in both cases the following fields must be filled in:

- authenticity code (3-digit number on the back of the card);

- Full name of the owner (copy the information from the card in English);

- address (in Russian or English you need to enter the street, house number, apartment number);

- city and region (language does not matter);

- index (google takes into account the index of the region, does not take into account federal cities);

- phone number.

How to pay for purchases using smartphones from various manufacturers

Systems from Apple, Google and Samsung are used for contactless payment. Let's briefly look at their features.

Apple

For the first time, support for contactless payments was implemented in the iPhone 6. After that, Apple engineers began adding an NFC module to all smartphones. In Russia, Apple Pay is supported by Sberbank, Tinkoff, Alfa Bank and many others. To use contactless payments on Apple smartphones:

- Download the Wallet app. This is an electronic wallet in which the user’s bank card numbers will be stored.

- In the Apple Pay block, tap on “+”.

- The most important secrets of a bank card - clear and simple

- Click "Next" and scan your bank card. The required data can also be entered manually.

- Enter the CVC code of your bank card.

- Wait for a confirmation code from your bank.

You can pay for purchases using Apple Pay only if you have the appropriate icon at the checkout.

The danger of paying with a bank card on the Internet: risks and scale

To pay for a purchase in a store, you must do the following:

- Double-click the side button.

- Enter your password, scan your fingerprint, or log in with Face ID.

- Place your smartphone against the bank terminal.

Samsung

Owners of Samsung smartphones can pay not only via NFC, but also using terminals that accept bank cards with a magnetic stripe. However, in Russia the latter method does not always work. On Samsung smartphones, contactless payments are configured as follows:

- Download the Samsung Pay app on your smartphone.

- Launch the Samsung Pay app and log in.

- Scan your fingerprint using your smartphone.

- Enter PIN code, password.

- Select the bank card you will use to pay with Samsung Pay. Take a photo or enter its details manually.

- Enter the confirmation code.

- Sign here.

To launch the payment application, swipe up from the bottom of the screen and log in using your fingerprint. After this, bring the device to the banking terminal.

Android

All Android smartphones, except Samsung, use Google Pay to make contactless payments. In order to use NFC payment, you must do the following:

- Download the Google Pay app on your smartphone.

- Launch the program. Log in if necessary.

- Tap on the “Add card” item.

- Take a photo of the bank card you plan to use for contactless payment, or enter its details manually.

- Click the "Save" button.

- Wait for an SMS message with a confirmation code from the bank that issued the card.

- To add another card in the “Payment” section, click on the “+” icon.

Shopping with AliExpress - how not to break the law?

To pay for purchases, you need to unlock your smartphone and bring it to the payment terminal. Additionally, you do not need to launch G-Pay. After the funds are debited, part of the card number used for payment will be displayed on the smartphone screen.

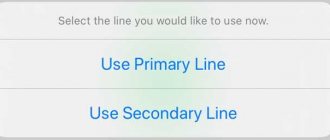

What to do if there are several contactless payment applications on your smartphone?

Banking applications can use all the most popular systems for NFC payments: Google Pay, Apple Pay, Samsung Pay. To ensure that when you activate the contactless payment function that you do not receive a request to select your preferred program every time, you need to make certain settings. On stock Android:

- Open the settings section and go to “Applications and notifications”.

- Select the "Default Applications" section.

- Find the “Contactless payment” item there and tap on the “Default payment” item.

- After this, a window will appear on the screen with a choice of a standard application for NFC payments.

In EMUI, the contactless payment program is selected a little differently:

- Open the settings section. Go to the "Other Connections" tab.

- Select NFC.

- Tap on "Default Application".

- Select your preferred transaction program.

In MIUI on Xiaomi devices, the NFC payment program is configured through “Additional features” in the settings or in the “Connection and sharing” section. There you need to select NFC, go to the contactless payment section and change the default application.

On Xiaomi devices, for contactless payments to work correctly, you need to activate HCE. This is done as follows: Settings - Connection and sharing (Additional functions) - Location of the security element - HCE.

Why link a card to your phone?

It is recommended to link the card whenever possible. Still, the easiest way is to have a phone with you that contains all the payer information. That is, the user enters his card information, confirms its accuracy and uses it according to the given instructions from the service. There is nothing complicated about this and even an untrained person can do it - no special skills in handling payment systems are required, which means it is possible to easily turn your smartphone into a tool for shopping in local stores.

To put it simply, by linking a card to your phone, you can forget about additional things - a wallet, which may not always fit into your bag/pocket. Moreover, the payment process is much easier with a phone than with a card. A person almost always holds a smartphone in his hand, and what needs to be done is to touch it to the terminal, confirm the action with a fingerprint (Touch ID), face (Face ID), and also using a standard password/code/pattern.

And besides, it is possible to combine several means of payment for different goods in your phone. For example, in Google Pay or Samsung Pay it is possible to link cards from different banks from each other. And although these are different companies, they use the same information for the operation - number, expiration date, CVV and carrier name. In general, using NFC is not only simple, but also “compact”.

Safety during contactless payment

To ensure the security of NFC payments, the EMV standard is used. It is used in all payment terminals that work with contactless payments. The system generates a one-time key and automatically redirects the request to the bank. If the ID matches, the money will be transferred to the seller's account.

Even if an attacker intercepts the key, he will not be able to use it, since each new transaction creates its own identifier. In addition, the NFC range is 10 cm. At this distance it is difficult to intercept any data.

Please leave your opinions on the current topic of the material. We thank you very much for your comments, responses, subscriptions, dislikes, likes!

Kristina Gorbunovaauthor

How to pay by phone

So, the technology is set up, your smartphone is ready for contactless payment. How to proceed:

- Check with the seller of goods or services whether their terminal supports contactless payment.

- Activate the NFC function.

- Make sure the screen is turned on and unlocked. Otherwise, the device will not be able to read data.

- Place the NFC antenna area of the device (usually the back panel) against the terminal.

- After payment, a sound signal from the terminal will sound indicating the completion of the operation.

Entering a PIN code is not required if the cost of the product or service does not exceed 1,000 rubles. In other cases, you need to enter a code; sometimes sellers ask you to sign the receipt.

Problems and solutions

Not a single NFC payment service works.

The likely reason is that the device does not meet the requirements for such applications, for example, you have root rights on Android . As mentioned above, the smartphone must not only be equipped with an NFC module - it must have the appropriate security measures that are needed to complete transactions. You won't be able to unlock this feature yourself using software, so you'll need to change your device.

Perhaps the corresponding function is present in your smart watch or tablet. Check - they also most likely work on Android or iOS.

Banking apps won't launch

An even more unpleasant variation of the previous problem is the inability to launch electronic wallet and bank programs. It is usually associated with a discrepancy between the installed OS version and the minimum required to run the application.

The ability to make payments via NFC makes smartphones even more multifunctional devices, because now, thanks to the availability of linking bank and promotional cards, the device can become a replacement for a familiar wallet.

Of course, there are several nuances, such as the impossibility of accepting NFC in some, mainly foreign, stores. In this case, which is not relevant for all devices, you can place your phone on the side of the magnetic reader, and the smartphone will emulate a real card. This function has been implemented by Samsung for a long time and a little later appeared in devices of other brands.

You can use G Pay and the like without the Internet, but only for a limited time and until you make several purchases. Then you still need to establish a connection to the Network.

Share link:

NFC Sberbank on iOS

In the case of iPhones, there are two methods for activating the function - through Wallet software and online mobile software.

Option 1 – direct subscription via Wallet

To do this you need:

- Activate identification and security functions Touch ID, iCloud.

- Launch Wallet.

- Find and activate the addition in the upper area of the screen.

- Enter payment details or take a photo of the front part.

- Confirm the holder's name, expiration date and CVV code.

- Accept the terms of the agreement.

- Authorization of the correctness of the entered parameters by entering the code that should come in SMS.

- Wait for the message: “ Card activated .”

Pay by phone - what does it mean?

For more than five years, terminals, which in this article refer to devices that accept bank cards at cash registers, have been equipped with an NFC receiver when released from the factory. This component allows you to read data contactlessly - you just need to present the bank card at a distance of a few centimeters or, even easier, touch it to the screen.

The same rule is relevant when paying with a smartphone, but before you use this function on your Android device (devices on iOS are also supported, but are not discussed in detail in this material), you will need to carry out the initial setup. It is the same for all banks if the actions are carried out within the Google Pay program. Some payment systems with their own apps offer the option to set up contactless transactions within them. In fact, it is not necessary to use such a function - for example, in the case of Yumani, payment both through the official program and using Google Pay works perfectly.

You can link several payment cards to your phone at once, and for this you do not need them to meet any complex conditions - it is enough to be able to pay in stores. The answer to another question that may arise before reading the main part of the article is “In what currency are payments made?” – all world currencies officially recognized by the international banking system are supported. There will be no problems in Russian stores.

Applications for payment via NFC

How to set up NFC for card payments? How to connect a card to a phone with NFC? These questions arise among bank clients and owners of smartphones that support the NFC function. As mentioned above, setting up “one-touch payment” is carried out through mobile applications. Some banks release their own applications, but most users prefer third-party programs. The difference is that the official bank utility (for example, Sberbank Online) adds cards from only one institution, while programs not tied to the bank add cards from different organizations.

Before connecting the card to a phone with NFC, install the application from the prepared list.

- Cards is a mobile wallet.

- Contactless payment – help. In addition to the main function - adding cards and activating payment, the application automatically determines before installation whether the smartphone supports the NFC function.

- VMCP.

- Visa Mobile CDET. The application works with Visa plastic in the PayWave payment system.

- MobilePay. The utility integrates card management in an interactive mode and supports settings for contactless payment.

- MyCard lite.

- CreditCard NFC Reader.

- WalletPasses | Passbook Wallet.

- SWIP. The application cooperates with Alfa-Bank and VISA, MasterCard and Mir cards. The built-in facial recognition function SELFIETOPAY makes payments using biometric identification.

The principle of operation of the applications is the same: the user adds the number of a real bank card (manually or scans), the program saves the information in the cloud and then makes the payment in PayPass terminals. Applications differ in the number of added cards, the ability to add discount coupons, and tickets.

For the selected application to work correctly, you will need a smartphone based on Android 4.4 or later, for iPhone 6 - iOS platform from 8 to 11.

Does my phone support NFC?

After linking your bank account, if you have a built-in NFC module, you can safely pay for purchases in any store. If there is no NFC, then after adding the card, in the program you will see something like: “Your smartphone does not support NFC payment.”

Let me remind you that NFC is a physical, not a software module, that is, it cannot be downloaded, and it cannot appear after flashing the phone. Read more about NFC here.

Or you can simply google information on your smartphone - whether it has NFC or not. On the other hand, you can ask me for this information - just write the exact model of your smartphone in the comments.

If you have an iPhone, then here is a list of all supported models: 5, 5S, 5C, 6, 6S, 6 Plus, SE, 7, 7 Plus, 8, X, Xs, Xs Max, XR, 11, 11 Pro, 11 Pro Max, 12, 12 Pro, 12 mini, 12 Pro Max, 13, 13 Pro, 13 Pro Max and newer phones. In fact, the iPhone is doing well with this plan, since almost all Apple smartphones support and have built-in NFC.

There is another way, for example, on Android - go to “Settings” and look for the “Bluetooth and device connections” section. If there is NFC, then activate it. If it is not there, then you can try to find the module by searching - look at the very top, click on the magnifying glass icon and enter: NFC.

Compatibility check

Before installing any services and systems, the user needs to make sure that the contactless option is activated on his device, and that the banking product is supported by a contactless payment system.

Activating NFC on Android

Activating NFC on Android (versions from 4.4 KitKat):

- Launch the settings menu (from the screen or notification area).

- Find the submenu “ Wireless from the Internet ”.

- Scroll down and enter the subsection "More».

- Open the subsection and find the NFC and Android Beam options.

- Check the box to allow data exchange.

- In the Android Beam line, check automatic activation or configure it manually by tapping on the line with your finger.

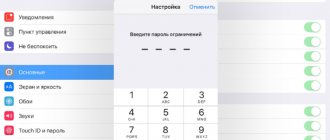

Activating NFC in iOS

Activation of NFC in iOS (versions from 6, SE) is not required.

You must immediately register cards through the Wallet service.

Compatibility check:

- Log in to the service online.

- Select the “ Contactless payments ” section or enter “Android Pay” or “Apple Pay” in the search bar.

- Scroll down the menu, find the section “ Required to connect ” and activate the line “ Full list of supported banking instruments ”.

- Make sure your type is listed.

- If you don’t have a card, you can submit a request for reissue or a new one.

How to find out if there is NFC

There are several ways to find out if you can pay by phone. Even before purchasing, you can look at the characteristics on the website or in the device documents. In addition, you can find the necessary information on the phone itself.

View the quick access menu located on the curtain. If you see the abbreviation NFC there, then the desired function is there. You can search for it in “Settings”. Depending on the model, the search path may differ, but in most cases it is “Wireless networks” - “More” (additional functions) - NFC. If there is an icon, and there is a slider opposite it, move it to the “On” position.

If NFC is not detected in quick or full settings, then the phone does not have such a function.