Huawei Pay in 2022 has become a very popular service among owners of devices from this company. Every year more and more people are switching to contactless payment via NFC, so it makes sense for developers to create authoring platforms. This Chinese company was no exception, which introduced a secure analogue of Apple Pay or Google Pay. Now owners of Huawei gadgets pay through their own profile application.

What is a Huawei wallet

Huawei Pay is a wallet through which you can make payments via contactless payment (NFC) on Huawei and Honor devices. The mechanism works like this:

- you open the application;

- choose a card;

- click on it;

- bring it to the terminal;

- he makes a request to write off the required amount;

- you confirm by entering a code or fingerprint.

In practice, making a payment takes up to a minute.

The situation is simplified by the fact that in Russia transfers up to a thousand rubles do not require entering a password. Payment transactions for goods or services are considered completely safe, since the server has several powerful protections installed. The developers took care of protection against hacking and information leakage.

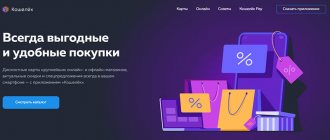

The idea of an application that would store various discount and savings cards for stores is simple and as old as the very concept of a telephone, which collects our whole lives. Similar things appeared on Symbian, let alone Android or iOS. But the Cardsmobile development that Huawei is betting on digs a little deeper; the Wallet app not only collects bonus cards you already have, but also gives you the opportunity to issue fresh cards right within it. And most importantly, what is most valuable for users of current Huawei smartphones is that you can add your payment (debit or credit) cards and thereby make contactless payments with your smartphone.

“Wallet” is available both in the Google Play or AppStore stores, and directly, without crutches, in the AppGallery - linking to Google or Apple payment tools is not required, the application works without them.

“Wallet” is designed in the spirit of the times and its name - minimalist, simple and adequate. The main screen contains all the cards that you have added to the application (the “Wallet” part is found independently by accessing your email during registration, some must be added manually), and in the form of a general carousel, without division by type. At the top of the working screen, you can go to the catalog of cards supported by the system (and register for some interesting bonus program, if you haven’t already), a recommended catalog of cards highlighted in a separate screen (this is how the creators of the application earn money on its content) and a mechanism for adding a card manually - even if Wallet has not yet established contacts with the store that issued the card, it can be photographed on both sides and presented digitally.

There is also a search bar, a notification panel where various promotions from the programs in which you are registered are poured in, and a settings panel that partially duplicates the quick access indicated above. There you can find a feedback form, settings, a help center, add your location and, for example, see a list of banks that already cooperate with Wallet.

This, of course, is the most important part of the application, allowing Huawei smartphone users to bypass one of Google’s most unpleasant sanctions restrictions - the inability to use the Google Pay payment tool, which for some time cut off any ability to pay through a smartphone “at the checkout.” “Wallet” returns this opportunity, albeit with some restrictions.

The most important thing is that it only supports MasterCard cards. But, despite the fact that the application was initially developed jointly with MasterCard, the creators claim that VISA will also be supported, but later; when is not specified. Right now only MasterCard. At the same time, everything is fine with the coverage of banks - many are already supported. Right now there are 40 banks in the system (including most of the largest), and several more (for example, Gazprombank and BKS Bank) are in the “Coming Soon” section. “Sberbank”, however, is nowhere to be found – and never will be; it has its own SberPay service, also available in the AppGallery. Yandex.Money was also recently added.

I tested the Wallet Pay payment system with a Raiffeisenbank card - and everything works easily, simply and without failures (as far as the network in the store allows, of course). True, to pay you do not need to confirm the operation each time by entering a password or fingerprint - just unlock your smartphone and the tool becomes available. This is, of course, easier, but the level of protection suffers a little. At the same time, the ability to take screenshots of the card in Pay mode is blocked (not with bonus and discount cards). Wallet Pay operates abroad without restrictions.

The creators urge you not to worry about general data security, stating that the service operates on the basis of its own tokenization platform, which has been certified according to the security standards of international payment systems.

In general, the experience of the application is the best - it is convenient, beautiful, well organized and works great, both in terms of its basic functionality (bonus and discount programs) and its more recent ones (contactless payment). There are some minor security concerns, but I wouldn't say that they impose serious limitations on the application's prospects. This is a completely adequate, albeit not complete (it lacks greater coverage of banks and support for the VISA payment system) replacement for Google Pay with an excellent “trailer” - a convenient storage of bonus and discount cards, where you can issue virtual cards directly in the application (in the future - virtual bank cards in the Pay system).

Which models have NFC built in?

Such a module is invisible to the naked eye, since technologists place it under the back cover of the device. The only way to find out about its availability is to read the instructions or technical specifications. In 2022, devices with built-in NFS are available in every gadget store. Their cost is not lower than average. That is, they are not present on budget models, but on 8,9, 9 Lite, the Pro and Smart line they can be seen often.

Why Huawei wallet doesn't work: reasons, what to do?

You can also check the availability of a port directly in the phone menu.

Huawei Pay vs Google Pay

At first glance, two identical contactless payment systems. But still, these systems have both similarities and differences. In order to be convinced of this, it is enough to compare. Payment methods comparison table:

| Huawei Pay | Google Pay |

| They work in Russia | |

| Same operating principle | |

| You can pay for all purchases and services | |

| Can only be used by holders of Gazprombank and Rosselkhozbank cards | Can be used by users of almost all banks in Russia |

| Only supports Union Pay card | Supports all types of cards |

| Works only on Huawei and Honor | Works on the following devices: Acer, Alcatel, Fly and Asus, HTC, Sony and LG, Lenovo and Huawei |

As we can see, Huawei Pay is inferior in functionality to the Google Pay system, but in its defense it is worth noting that it only recently appeared on the market and has not yet developed sufficiently.

How to set up Huawei Pay

If you are convinced that there is an NFC chip on the device, proceed to the immediate procedure for setting up payment. You will have to do it once, and then you will only have to confirm the debiting of funds. The algorithm is like this:

If you have any questions or complaints, please let us know

Ask a Question

- move the NFS sensor to the active position;

- open Honor Pay;

- create an account;

- add a card and personal information on it;

- go through identification via phone number;

- the software is ready to use.

Huawei Pay in Russia

For Russia, the method of payment with a gadget has long been nothing new. The first systems in Russia through which such payments can be made are Samsung Pay and Apple Pay. Then Google Pay joined them. The latest to appear on the Russian market are Huawei Pay and Honor Pay - available from the beginning of 2022. Russia has become the second country after China in which this payment method works. The operating principle of the above systems is similar. The difference is that the systems do not work on all devices, each with its own line of smartphones.

How to use Huawei Pay

To make a payment, you need to bring your phone to the terminal marked Pay Pass. Once the device is closer than 10 centimeters, the phone will beep. All you have to do is confirm the transaction if the amount is more than a thousand rubles.

Where to download the application

The download is available in the official Android software store - Google Play. Downloading from third parties is rarely secure and may result in the loss of personal information.

Contactless payment via card

Payment card details appear in the software memory. Even if there are several of them, and they belong to different banks, you still add them for use. This will not affect your accounts or balance in any way. When debiting funds, you indicate the one you want to pay with.

Why Huawei wallet doesn't work: reasons, what to do?

Wallet activation

We can activate the function by entering Wallet, which is located in the toolbox on the desktop of our mobile phone. To gain access, we can use the same Huawei ID that we have configured on the mobile phone, since this is a requirement for login. Once we have entered, we will have to accept the terms of service and access Permissions for the camera (for reading cards) for SMS (for verification codes) and for storage (for registering applications).

Insert cards

Once we have accepted all the permissions, we can start adding our cards to the wallet. The method can be done by scanning or by manually entering data. In this case, we will need to enter the relevant information, which includes the card number, expiration date or CVV2 number.

Final inspection

The application will transmit the data of this card to the service operator to verify the validity of the card. You will then receive a token on your phone, which is an additional key to verify transactions. A token must be activated before it can be used for payments. You can choose a verification method to activate the token.

Finally, and once the card is added to the wallet, we can use the fingerprint or PIN on the phone and bring it closer to the card reader that supports contactless payments . This way we can pay without having to take out the wallet and take our physical cards .

Which Huawei models support contactless payment?

Unfortunately, not all mobile devices support contactless payment. The most important condition is the presence of an NFC module in the design of the smartphone. The Chinese manufacturer is currently releasing all the latest models that support this technology. You can find out for yourself whether a microchip is installed or not. The corresponding logo is displayed on the inside of the back cover. If the cover is not removable, then it can be seen on the phone body. To find out for sure, turn on the device and look in the system settings for the presence of this function. But there are also cases when the module needs to be launched manually. To do this, go to the smartphone settings and the wireless access section. Here, give permission for contactless information exchange.

Currently, the Huawei Pay application is actively used in China, but there are plans to capture a large market. Manufacturers have provided a list of compatible equipment:

- Huawei Mate 20, 20 Pro, 20 RS Porsche.

- Huawei P20, P20 Pro.

- Huawei P10, P10 Plus.

- Honor #9, #10, #V10.

This list of mobile devices is constantly growing, and soon the entire range will support universal technology. Older smartphones do not have such a chip installed, but this is not a problem. To resolve the issue, purchase a special antenna or external NFC tag.

Please note that the application will only work with the original firmware of the mobile device and the latest system update.

What is NFC

Let's start the article with a description of the technology on which all modern payment services operate. NFC is an abbreviation for near-field communication. This development creates wireless transmission of information over a short distance. To transfer data from one device to another you will need to bring them close to each other. This method of exchange has wide potential and is used in digital technology.

Currently, NFC microchips are used in the financial sector to make contactless payments in stores. Almost any modern smartphone is equipped with a similar module. This makes life much easier for the consumer; you no longer need to carry a wallet, cash and coins in your pocket.

Any payment transaction is carried out through a mobile device, which we rarely leave for long. But this is only a small part of its functionality. Now you can buy Smart watches, rings and individual NFC tags and program them to perform any functions, from unlocking your smartphone to paying for public transport.

We are only interested in contactless transactions. The main condition for a successful purchase is the presence of the same module in the receiving device - the reading terminal. Almost every store and even kiosk has special equipment for processing payments. Only in remote outbacks do they still accept cash. Let's consider the advantages of using such technology in the financial sector:

- Ease of use. Now, all your money is in your mobile device.

- High speed reading of the NFC module. Payment for goods occurs instantly in one touch. To do this, just bring your smartphone close to the reader. You don't have to wait for the seller to give you change.

- Safety. Payment data is stored directly on the NFC microchip, which has no connection with other applications of the mobile device, which eliminates the possibility of viruses. Data exchange with the terminal occurs within a small radius, so fraudsters will not be able to read personal information. When making a purchase worth more than 1000 rubles, you must enter the security code of your bank card.