Paying for any purchase without using cash is easier than ever today. You don't even have to take your credit card out of your wallet to do this. The NFC system allows you to do this without touching the terminal, but simply by bringing a card, smartphone, watch or other device to a certain distance from it. This unique method is rapidly gaining popularity all over the world, as it takes purchasing goods to a completely new level of convenience. However, questions remain regarding the safety of its use. In this article we will talk about contactless payment technology with bank cards, explain what it is and how to use it correctly.

What kind of way is this

The essence of such a payment is that it does not require direct use of a credit card in order to write off money from it. If earlier a transaction was accompanied by inserting funds into the terminal or transferring it through a magnetic stripe, now it is enough to keep it at a close distance from banking equipment.

The device reads the information and then transmits it to the acquiring center, which will authorize or cancel the operation. It is especially important that the use of a card for a contactless payment system is possible from external technical means: a smartphone, watch, bracelet, to which the payment instrument is linked. The card itself can remain at home.

Credit cards that allow payment without direct contact, as well as retail equipment that accepts them, have a special marking - PayWave or PayPass, as well as an additional logo design. If you see such a sign in a store, you can be sure that this method is available at that point.

What is the name of the system

Contactless payment technology is known as NFC - Near field communication. Translation: “close communication without contact.” Let's analyze each word to better understand how the technology works.

The term “near” means that data exchange can occur within a short distance of technical devices from each other. It does not exceed four centimeters.

The meaning of the word “no contact” is that the relationship does not require direct contact of the card with the point of sale terminal. Data is read using magnetic field induction. The word “communication” is also very clear and logical and denotes the interaction between two technical means.

Thus, it turns out that the NFC system is an exchange of data between 2 devices using the principle of magnetic influence. This definition does not reveal the entire essence of technology, but demonstrates its main features.

Functions of NFC technology in everyday life

NFC, which is translated as “near field communication”, is far from a new technology. The chip was first installed in the Nokia 6131 phone in 2006, but the trade and banking infrastructure was not yet ready for its use.

Now it is used:

- in electronic fare payment;

- for transferring data and funds from smartphone to smartphone (like the infrared port once did);

- in electronic keys with personal information of the employee;

- in special tags for storing important business data.

Even the usual connection of a smartphone to any device using a USB cable can now replace the NFC chip. You just need to bring your phone to the printer to print the desired photo or play a video on your TV by connecting to the device’s remote control.

Contactless payment method

The idea of using wireless data transmission itself is not new. The first standard of plastic cards capable of making payments without direct interaction with retail equipment appeared back in 2004. The main feature of the system lies in the combination of a smart card interface and a small reader into one device. It took its basis from the RFID radio frequency identification method, which makes it possible to transmit data over a radio channel.

Previously, a similar technique was used to accept payments in vehicles, but today it has switched to working with banks. Mostly modern smartphones and tablets are used for this. They can provide sufficient security for funds as they are equipped with good data protection systems. But the NFC chip can be placed anywhere: in a bracelet, digital watch, or ID card.

Now payment rings, bracelets, watches, some kind of stickers are appearing - does this make sense?

Many payment market experts believe that wearables - rings, bracelets, watches, key fobs, active stickers / stickers, etc. - have a good future. They are primarily secure because they are designed with security in mind, the operating environment of the wearable device supports a limited set of applications, and malware is not easily placed on them. Devices interact with the outside world through a limited set of interfaces (usually only NFC, to which BLE is sometimes added), and finally, some devices have a biometric fingerprint sensor to verify the user.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Loading a map into your phone and managing it

The correct operation of contactless payment largely depends on the correct linking of the bank card and the possibilities for its further management. First of all, you will need to install the most suitable application for NFC in accordance with your phone model and your own preferences.

The bank card must be compatible with the payment application. To add you need to do the following:

- Login to the application, enter personal data, identification.

- Clicking the “Add new card” button.

- Scanning a card using a camera or entering details manually into a special form.

- Selecting a method for confirming payment transactions - fingerprint or other.

- Completing the process, saving all settings.

The plastic card turns into a virtual copy, preserving the balance and other data. If necessary, you can add other cards, including from different banks. The first registered card becomes the primary card for payment by default. If necessary, it can be replaced with another one through the application settings.

Contactless payment function on cards

As mentioned earlier, the possibilities for using technology are almost endless. The functionality becomes available to clients of MasterCard, Visa payment systems and some categories of Mir cards.

In the last couple of years, the NFC system has been installed in plastic by default, so there is no need to order it as an additional feature. We are talking only about personalized debit and credit cards. Instantly issued payment instruments that do not have the owner's name on the front side allow you to pay for purchases only using the old methods: using a magnetic tape or a simple chip.

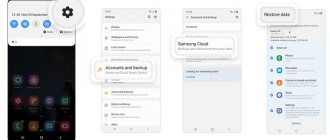

Applications for managing contactless payments via phone

We have already described how to enable the NFC function on your phone above. But for it to work properly, it needs synchronization with your account. There are several apps to manage your payment information:

- Apple Pay;

- Google Pay (aka Android Pay);

- Samsung Pay;

- Huawei Pay;

- SberPay;

- YuMoney and others

The first four applications from the list can be integrated with most cards of Russian banks: Sberbank, VTB, Alfabank, Tinkoff, Rosselkhozbank, Promsvyazbank and others. And SberPay and YuMoney are examples of applications created by companies specifically for their clients.

Advantages and disadvantages of contactless payments

The technology has a lot of advantages, otherwise it would not have developed and spread so actively. Among other things, it is valued for:

- Possibility of fast operations.

- No need to give your card into the hands of a stranger.

- High technology.

- Convenience and comfort when shopping.

There are also disadvantages, but over time they become less and less. The most important of them can be considered a small number of retail outlets whose equipment supports NFC. Financial institutions themselves, which are acquirers for stores, are struggling with this disadvantage. They are gradually replacing the terminals with new equipment, which makes it easy to use the service.

Another problem that you really encounter is the fairly high price of retail equipment that supports contactless cards. This is especially difficult for owners of small retail businesses. But upon closer examination of the issue, they often change their opinion.

Are there any reported cases of such fraud?

“Today, fraudsters have more effective means of stealing money from the point of view of their risks and costs than contactless cards,” points out Igor Goldovsky. — I personally do not know of any cases of theft of money through contactless cards using a store terminal. I asked my colleagues from banks and other payment systems - none of them had encountered such a problem in practice. If we talk about fraud indirectly related to contactless cards, then we can primarily talk about lost or stolen cards. A fraudster who has such a card in his hands can use it to perform transactions for amounts less than the established limit until the issuer blocks such a card. Therefore, I would like to remind you once again about the need to be careful about storing your bank cards – contact and contactless.”

How the system works

In general terms, the work scheme has already been presented above. Credit cards have an internal chip that emits radio waves through an antenna, the same ones that are recognized by RFID technology. The terminal itself is equipped with a reader that captures data.

When the client brings his “plastic” to the trading equipment a short distance, the signal from the medium is read and identification data is processed. At the same time, small purchase amounts do not require any additional confirmation at all; for large purchase amounts, you must enter a PIN code.

You need to hold the card at the bank terminal for a couple of seconds. This time is enough to obtain all the necessary information and transfer it to the acquiring center. So that the buyer knows exactly when to remove the payment instrument, the device emits a sound signal.

Methods of contactless payment by card

It was previously indicated that PayWave or PayPass methods can be used to make payments without real contact. The first is actively used by the Visa system, the second by MasterCard. There are other options designed specifically for American Express, UnionPay and other operators. But they are all built on the same principle of operation, so they cannot be called very different, much less unique.

In this situation, the method for making payments is always the same: to make a purchase, you need to bring your payment instrument to a terminal capable of picking up the radio frequency on which the chip transmits information. Moreover, exactly the same option can be used if, instead of the credit card itself, you bring another technical device (smartphone, watch, fitness tracker) to the equipment. The difference, which depends solely on the bank and the country, can be traced only in the amount that can be transferred without entering a PIN code.

How do you know that a card has a BO function?

- The most basic way is to simply carefully examine the card, namely its front part. The front side of the card has a special symbol that looks like “))))”. In addition, on it you will see the golden chip itself, which must be applied to the terminal;

- Now every popular payment system in our country has a BO option. For Visa this option is called payWave, for MasterCard - PayPass, MIR - Mir Pay. If the card has a BO, then you will see this name on its front side (sometimes on the back). From here, you just need to look for these names on the card to understand if it has a contactless payment option?

- The third method is the most accurate. You just need to bring the card to a terminal that supports this option. If the terminal makes a payment, then contactless payment is available. If not, then there is no trial.

How to use contactless payment

It is very easy to learn how to make purchases using the NFC system. This does not require any special action. The general scheme looks like this:

- The cashier enters the necessary information into his cash register or banking equipment.

- The buyer checks the correctness of the entered amount on the terminal display.

- The payment instrument is brought to the reader at a distance not exceeding 10 cm, sometimes it should be reduced to 4 cm.

- After receiving a sound signal, the card can be removed.

- When prompted, you must additionally enter a PIN code. This happens if the spending limit is exceeded without special control. In Russia, the amount is 999 rubles, everything that costs more must be confirmed with a password.

The entire procedure takes a few seconds, after which a receipt is printed confirming the debiting of funds. You can pay for goods this way either in a small store or in a representative of a large federal chain.

Is it possible to steal money from a card using a fake terminal? Does it exist?

From time to time, stories pop up in various media about the danger that scammers with fake terminals can steal money from people’s cards in a contactless way.

Igor Goldovsky is sure that scammers have little interest in this method. “From a distance of 40-50 centimeters, with certain modernization of the terminal, it is possible to initiate an operation using a contactless card without authorization of its holder. But it is important to understand that the terminal itself, with the help of which fraudsters are going to steal funds, must be registered with a bank that is a participant in the payment system, and the store itself, to which the terminal is assigned, must have an account with the bank, he explains. — Without an account, fraudsters will not be able to receive the funds that the holders of those contactless cards allegedly paid to the fraudulent store. As noted above, the size of a contactless transaction without verification of the card holder is limited by a limit (in Visa in Russia it was recently increased to 3 thousand rubles, in all other systems it is 1 thousand rubles. - Ed.). In our country, the vast majority of transactions are carried out online with authorization from the issuing bank. Therefore, risk management procedures on the side of the bank issuing the card are immediately triggered.

In addition, even if the funds were written off in this way, the fraudster would still not even have the opportunity to receive the money, because the terminal with which such fraud attempts can be made, as reported in some media, must be registered with the specific store that serves specific bank."

How to set up NFC to pay with your phone

Most modern mobile devices support this calculation system, but require a special preparatory procedure. Each manufacturer offers a number of slightly different actions, but in its most general form the scheme looks like this:

- First you need to open the basic settings of your smartphone.

- Next, you should find the “Wireless Networks” tab and click on the “More” button.

- In the drop-down list, look for the contactless payment function and give permission to use it.

- Next, you should link your plastic card to your Google Pay account.

After completing all the steps, you can start using the technical tool for calculation. The presented scheme applies to devices running on the Android operating system. Devices using iOS are configured properly from the moment of purchase. You just need to link a credit card to them.

Google Pay

An ideal solution for almost all devices running on the Android operating system. The only requirement of the developers is that the software must be no lower than OS version 4.4, otherwise the service may not work correctly. The application provides its users with the opportunity to make transactions for goods purchased on Internet sites, make one-touch payments in retail chains, cafes, restaurants, parking lots and gas stations.

Since the principle of making financial transactions using the applications discussed in this article is carried out in a similar mode, let’s consider how contactless payment technology works using the example of the most popular Google Pay application among Russians:

- first of all, you need to launch the option to unlock the home screen - you do not need to activate the application itself;

- then turn the device around with its back side and bring it closer to the reading device;

- a request will appear on the splash screen - from the options offered by the service, select “credit” (this option is used for any type of card, even for debit);

- If necessary, enter a personal PIN or sign on the receipt.

If the user has several cards, you need to open a list of them, put a mark next to the one you need indicating that it will be the main one at that moment in time, and only after that should you bring the phone to the terminal. For the transaction to be successful, the device must not be in sleep mode. The operation can be considered completed only when a green flag appears on the screen. This means that the money has been debited from the personal account of the plastic holder.

Safety

Many clients, in addition to the question of how contactless payment by bank card works, are also concerned about the safety of its use. Will it be possible for scammers to write off funds simply by being next to the bag in which the card is located? How to protect your money? In reality, the risk when used correctly is minimal.

To minimize the possibility of illegal actions in relation to your funds, it is enough to follow 2 simple rules:

- Reduce the maximum threshold for payments allowed without PIN code confirmation.

- Set a certain limit on the number of transactions performed using NFC.

Another way to increase security is to pay using a smartphone. They themselves require additional identification, which eliminates the possibility of committing fraudulent actions. Connected SMS notifications about purchases will also help reduce the risk.

How does contactless payment differ from contact payment?

The contactless card chip contains a payment application that can operate via both contact and contactless interfaces. Before the transaction begins, the card and the terminal already “understand” through which interface they will interact.

Depending on the interface used, the transaction is processed according to the rules corresponding to this interface.

The terminal selects the appropriate software on its side, and the card payment application selects the appropriate profile for performing a contactless transaction: individual limits on card use, risk management parameters, cardholder verification lists, and the like. The difference between contactless and contact modes of a payment application is always present. For example, in contactless payments, offline PIN verification is not used at all, the “cardholder name” parameter is not read, and so on.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

How popular are remote payments?

The prevalence of the NFC system in trade and services is growing every day. If 3 years ago the total amount of purchases made using contactless payment was no more than two billion rubles, then just a couple of years ago it doubled. Progress is increasing every month, and technology has migrated from large cities to small towns.

According to statistics, this is especially popular when making payments to the service industry, be it a restaurant, club or amusement park. It is also preferred by public transport passengers. This is understandable, no one wants to bother with small cash in a bus crush. True, there is another side to the issue: the representatives of the organizations themselves are very reluctant to change the already installed banking equipment to new and more expensive ones. So, we can say that the frequency of using contactless payments at the moment depends only on entrepreneurs. Buyers are ready to use them.

Advantages and disadvantages

Advantages:

- reduction of time for payment transactions;

- comfort;

- eliminating the possibility of double write-off;

- with careful use, increased protection of card data;

- reduced wear of plastic due to the absence of constant friction against the terminals.

Flaws:

- unhindered payment up to 1000 if the card falls into the wrong hands;

- contradictory attitude towards NFC technology in terms of access to information about a person’s location.

Organization of remote payment

Today, almost every retail outlet already has POS terminals installed, making it possible to make cashless payments. Some of them have a built-in contactless system. Beginners who are just starting their own business, and those trade representatives who have old equipment, should follow the same scheme:

- Study the offers of banks providing acquiring. Every detail is important: tariffs, devices provided and conditions of their service.

- Select one option and submit a request to connect NFC-enabled equipment.

- Provide specialists with access to the seller’s workplace for installation and configuration of the terminal.

After this, you can begin to actively use this method of accepting payments in your store. Buyers will note this option as very convenient and effective, which means the level of sales will increase.

What is the convenience of such devices?

In terms of user experience, wearable devices are considered the most convenient means of payment. Unlike a phone, it's easier to pay with a wearable device: you don't have to take out your phone, activate it, and open the payment application in it.

For example, a person touched the reader with such a “smart” watch - and the transaction occurred. After reading information periodically appearing in the media about malware on phones, the user rightly thinks that wearable devices are safer.

Finally, wearable devices can be in demand among young people and multifunctional, with the payment function being secondary. At first you just buy a fitness bracelet, and the ability to pay with them is a good addition to the main functionality.

Review of Courier software

This software is ideal for running an online store using a mobile POS terminal. If previously only one payment method was available to such organizations (directly on the website at the time of purchase), today you can pay for goods completed and delivered by courier at home, at the time of its transfer. In this case, the sale will be accompanied by the issuance of a real receipt, as required by the latest innovations in legislation.

The whole process is automated and does not take much time. The diagram looks like this:

- The client places an order and decides to choose a convenient payment method.

- The online store processes the application and sends it to the specified delivery address.

- During the transfer of the purchase, the supplier uses a mobile terminal on which the Mobile SMARTS: “Courier” software is installed.

- The information is sent to the acquiring center, and a receipt is printed confirming the transaction.

- The information is forwarded to the fiscal data operator, and from there to the tax service.

The entire process takes just seconds and is absolutely safe for all parties. In addition to the terminal itself, the software can be used on a smartphone, tablet or TSD, which significantly expands the seller’s capabilities.

Applications and specific examples

In the fall of 2022, Russia, according to a study by the international consulting company BCG, became the world leader in the number of contactless payments, in the volume of secure tokenized transactions carried out using a smartphone, and the largest European market for digital wallets.

Cellular operators were the first to take up the development of NFC. Megafon has installed devices with NFC readers in all branded stores, with the help of which customers can make payments from their mobile account. In addition, the operator sells SIM cards that support contactless payment technology.

Beeline helps pay for trips on the metro: a SIM card with NFC support is inserted into the phone, with which you can both pay for travel and purchase a certain number of trips and turn your smartphone into a travel ticket.

Contactless payment optimizes and improves the quality of service in retail:

- Increases the average bill - it is psychologically easier for the client to part with money when he sees only numbers on the screen.

- Reduces queues and speeds up the cashier's work - to pay, just bring your smartphone to the terminal.

The “Mobile Ticket” service from Moscow Transport allows you to pay for travel on ground urban passenger transport, the metro and Aeroexpress. Payment for travel occurs with one touch of the smartphone to the transport operator’s device.

Sberbank offers to pay for purchases in stores and on the Internet using a smartphone and the Google Pay service, which must be connected in the Sberbank Online mobile application. Using contactless payment technology is simple:

- Unlock your phone and bring it to the payment device.

- “Ready” will appear on the screen and a beep will sound.

There are special applications for convenient storage of bank and transport cards, and for secure contactless payment. One of the most popular is the “Wallet”, which allows you to pay for purchases, receive certificates, coupons, store all types of cards and even apply for loans through the built-in “Offers Store”.

But NFC technology is not limited to contactless payments. The scope of application is very wide: for example, it could be a billboard with a QR code with a traffic map and public transport schedule; various tickets, coupons, passes.

Developers of Tokenize Inc. created a “smart” Token ring that combines NFC and Bluetooth technologies and replaces all possible types of plastic cards, keys to locks and stores passwords from other devices.

Meanwhile, the coronavirus pandemic has significantly impacted the prospects for contactless technologies. The country has introduced a self-isolation regime: museums, theaters, educational institutions are closed, and people try not to leave their apartments. Contactless technologies allow you to spend time productively while being safe. Having assessed the convenience and safety of using new methods, users are unlikely to want to return to old methods.

We have selected the TOP 11 contactless technologies that will help you save yourself from coronavirus.

Apple Pay, Google Pay (formerly Android Pay) and Samsung Pay - contactless payment with electronic money (NFC)

Apple Pay, Google Pay or Samsung Pay allow you to pay for goods and services at retail outlets that are equipped with terminals, including those without Internet access. You can pay using applications and in online stores they support payment both through a terminal, but also in online stores and through a terminal without an Internet connection. The payment mechanism is simple: you need to bring a smartphone with any of the applications to the terminal and wait until a notification about a successfully completed transaction appears on the display.

Apple Pay allows you to connect up to 8 bank cards and supports 90 Russian banks, as well as applications: Aeroflot, KinoPoisk, Wildberries, Yandex.Taxi, Yandex.Eda, Lamoda and others.

Google Pay supports cards from Visa and MasterCard and works with loyalty cards. In total, the application has about 97 possible contactless payment methods. You can connect cards in unlimited quantities.

Allows you to pay for purchases without the Internet using the NFC chip, but no more than 6 in a row. Payments are available in Chrome, Safari and Firefox browsers, as well as in KFC, Azbuka Vkusa, H&M and others applications.

You can link up to 10 cards to Samsung Pay at the same time. The application supports more than 80 companies and banks.

Turbo, Tinkoff gas station, Yandex.Navigator - pay for gasoline without leaving the car

Tinkoff has created an application that allows you to pay for fuel at gas stations without leaving your car. The payment process through the Tinkoff Gas Station application is much faster than through the operator at the checkout.

Applications for contactless payment at gas stations allow you to present fiscal receipts. A link to the receipt will be sent in a convenient way after payment: via SMS or messenger.

A similar service, Yandex.Zapravka, has been successfully operating since 2017. Gas stations, Neftmagistral, etc. are connected to it. Gazprom Neft gas stations have their own service for contactless payment, Gas Station.GO.

“Turbo” is a convenient application that allows you to refuel your car without leaving it. More than 400 gas stations are already connected to the application.

Thus, contactless refueling applications allow you to pay for fuel without touching cash, bank cards, the refueling nozzle or gas station doors. During a pandemic, this is a serious way to protect yourself from contact with infected people and surfaces that can carry infection.

PIK Rent, Keyrent - viewing apartments without the participation of a realtor and owner

During the coronavirus pandemic, any contact becomes potentially dangerous. The ability to view real estate without the participation of a realtor and owner is an excellent opportunity to avoid unnecessary meetings.

Remote viewings with the services “PIK Rent” and “Keyrent” allow you to visit apartments without unnecessary contacts: the client just needs to contact the agency, informing them of their desire to visit the property. The realtor will tell you where the keys to the property are located: usually they are left with the concierge or in a company safe. The apartment is equipped with cameras, with the help of which the consultant will accompany the client during the viewing and answer his questions. You can read more about the services on the official websites.

Google Arts & Culture and online tours of museums around the world

During the coronavirus epidemic, all cultural institutions are closed, but there is an excellent opportunity to visit museums online. Google Arts & Culture is an online platform that allows anyone to access high-resolution works of art and museum exhibits.

You can virtually visit the most famous exhibitions, visit previously inaccessible museums, listen to opera and even go into space here. All online tours are free of charge.

Zoom, Google Hangouts, Skype - online conference services for work, study and communication

In connection with the pandemic, the Ministry of Education announced the transition of students to distance learning, some enterprises were transferred to remote work, and a regime of self-isolation was declared in the regions. The platforms Zoom, Google Hangouts, and Skype are suitable for holding online conferences, work negotiations, school lessons, and just for communication.

Zoom is a convenient platform for distance learning. Registration is required to create an online meeting. The platform allows you to divide students into classes, transfer files and switch to an interactive whiteboard.

The free version of the account allows you to arrange a video conference lasting no more than 40 minutes, which is quite enough for one lesson or a conversation with loved ones.

Using Google Hangouts, users can create video meetings, make calls over the Internet, and also synchronize their conversations: for example, start a conference on a laptop and continue on a smartphone, which is very convenient in conditions of distance learning and work.

In April 2022, Google rebranded its Hangouts Chat and Hangouts Meet . They are now called Google Chat and Google Meet .

Training, work and friendly meetings via Skype are a new reality during a pandemic. The program allows you to exchange messages, conduct group video calling sessions, and share files for free.

Platypus, iGoods, Scooter - grocery delivery services

Delivery services allow you to receive fresh products without leaving your home and without risking your safety.

In Utkonos you can select the necessary products both from the catalog and from the Utkonos Recipe Book. The client will need to decide on the products, add them to the cart and pay with his card or other payment system. After paying for the order, you have access to tracking the courier, who is already in a hurry with your order.

iGoods couriers collect orders in the store and deliver them in thermal bags in just 90 minutes. The service cooperates with large supermarkets: Metro, Lenta, Karusel, Vkusville, etc.

The Samokat service promises to deliver groceries for free in 15 minutes, choosing from more than 2,000 items in the catalog.

Google Earth VR - travel in virtual reality

Using a virtual reality helmet and Google Earth VR, you can travel around the world, exploring it from any point: the platform allows you to climb the Great Wall of China, approach the Statue of Liberty, sail along the Amazon, or conquer space, observing the planets from virtual orbit.

The service is free on Steam, the largest online digital distribution service for computer games and software, so owners of compatible headsets can explore the planet without leaving their apartment.

Services for distance learning

We have selected the TOP 3 current services that allow you to remotely improve your skills or learn a new profession.

- Yandex Academy is a project for people who want to develop in the field of information technology. Yandex specialists will introduce students to modern approaches to web design and development, teach how to create Internet products and analyze data. Here you can sign up for courses, apply for participation in a certain school, an internship at Yandex, or take part in a programming competition. The platform has a wide range of educational materials on various topics: from management and design to machine learning and information security.

- Coursera is an education company that offers online courses. The vast majority of programs are available in English with subtitles in several languages. Coursera works in partnership with several universities and offers training in various fields: physics, mechanical engineering, medicine, biology, mathematics, business, computer science, etc. Nowadays, almost anyone with no knowledge or experience can take excellent courses through Coursera courses.

- KhanAcademy is a non-profit educational organization founded by Harvard MIT graduate Salman Khan. Khan Academy's goal is to make world-class education accessible to everyone, anywhere in the world.

Training systems differ in functionality and meet specific goals, so each user is given the opportunity to independently choose the appropriate service.

Gosuslugi.ru, mos.ru - online government services

Due to the spread of coronavirus infection, it is recommended to apply for government services electronically. Services of federal authorities (for example, replacing or obtaining a passport, processing benefits, extending subsidies for utilities, etc.) are performed virtually by the Unified Government Services Portal.

mos.ru is the official website of the mayor of Moscow, allowing you to access your medical record without visiting a clinic, make an appointment with a doctor, submit readings from water and electricity meters, pay fines, sign up for a sports section and much more online.

To reduce the likelihood of contracting COVID-19, you should use public transport as little as possible and avoid visiting crowded places: the Gosuslugi.ru and mos.ru services allow you to receive most services remotely.

Self-service checkouts in stores

Self-service checkouts developed by the largest Russian retailer X5 are already operating in Pyaterochka stores, Perekrestok supermarkets, and Karusel hypermarkets, reducing the need for service personnel and speeding up the payment process.

The Vkusville chain of stores offers its customers to scan the barcodes of products themselves in the Supercheck application: to do this, you need to go to the self-service checkout, scan the code from the smartphone display and pay for the purchase.

Such cash registers, equipped with a microphone, speakers and a 3D camera for accepting payments using Face ID technology and working with voice services, allow you to make purchases without standing in lines.

Facial recognition system in the subway

Facial recognition, in theory, will help collect fares using video identification of a passenger in a crowd.

According to Moscow Mayor Sergei Sobyanin, almost 2.5 thousand quarantine orders were issued during the pandemic, and the facial recognition system in the metro helps monitor and stop attempts to violate isolation. In addition, the system will help reduce crime rates.

By analogy with facial recognition at ATMs, the passenger is identified and the cost of the metro trip is debited from the virtual Troika. One of the goals of installing a facial recognition system is to speed up the passage of passengers who will no longer have to put their card when touching the machine and stop in front of the turnstiles.