Advertising ⓘ

In the new era of mobile shopping, apps like Apple Pay and Google Pay give today's consumers more freedom than ever before. Instead of carrying your wallet, credit or debit card with you wherever you go, you can use the Google Pay app as a payment method.

Consumers can simply flash their phone to make a purchase over an NFC connection. This gives modern merchants more flexibility when it comes to offering customers the payment options they most desire. In 2022, Google updated its online and mobile payment solutions, bringing everything under the single umbrella of Google Pay.

Consumers can use Google Pay for online payments, contactless purchases, in-app purchases and more. There is even the ability to share money from person to person, just like PayPal. Today we'll look at everything you need to know about Google Pay and help you decide if it's the right service for you.

What is Google Pay? Basics

Google Pay is a mobile service that allows users to purchase goods and services using a compatible Android phone with an NFC chip. You can also use Google Pay using your tablet or watch. This online payment system and digital wallet provides a convenient solution for customers in the digital world.

It's also a great way for merchants to provide their consumers with more payment options. As you may already know if you're a business owner, additional features like Android Payment and Google Wallet Payment instantly make your store more attractive.

Google Pay allows users to enjoy the benefits of contactless payments without using a physical visa or MasterCard. You don't need to carry a wallet with you to use your Google account or remember your credit card number. If your device has a compatible card, then you're ready to go. To use Google Pay effectively, all you need to do is download the app and log in to your Google account.

You can access Google Pay through the Google Play Store on your Android phone. Once you're signed in, you can set up your preferred payment method, which will have your transactions processed every time you use Google Pay.

Business owners and merchants can use the Google Play service with theirdividual checking accounts to instantly start accepting electronic payments. Payments will be sent directly to your bank account using Google Pay. no commission to worry about.

Create NFC tags

Using NFC technology, it is possible not only to make contactless payments, but also to perform other actions. For this, there are special tags equipped with chips that act like a QR code. Only the information is read not by the camera, but by the NFS module.

Customized tags trigger the smartphone to perform certain actions. This could be calls to specific subscribers, sending letters or SMS, opening applications, setting an alarm, etc.

Program NFC tags in the following order:

- An NFS label is purchased.

- Connects to a smartphone via an app.

- Information about the actions that need to be performed is entered.

- The programmed tag is placed in any convenient and accessible place.

When a smartphone comes into range of the tag, the task is read and then automatically executed.

Key Features of Google Pay for Consumers

Google Pay has two levels. First and foremost, it is a digital wallet and a convenient way for consumers to shop. With the mobile app, users can make purchases online, in store, and through apps. Google Pay is also good for sending money to friends. For clients, features include:

- Supports major banks in the US and 28 other countries

- Integration with various mobile banking applications

- Online payments in store and in the app

- Accepted in over a million stores that accept NFC

- Use and save mobile tickets, travel cards and boarding passes

- Multi-level fraud protection

- Request cash in the app or send money

- Instantly transfer money to your bank account

Google Pay is a convenient way to make payments across multiple environments for free and with absolutely no fees. You can easily set up and use this service, making it an attractive choice for customers looking for a fast digital payment solution.

Key features of Google Pay for merchants

For merchants, Google Pay also has many significant benefits and features to explore. You can easily integrate with the Google Pay API so you can customize the service to work with your online store and other sales channels. For businesses, it's easy to set up and use a Google Pay account at the bank you already use to accept consumer payments.

With Google Pay for Merchants you get:

- Customized Business Channel : Make it easier for customers to find your business using the Google Pay app.

- Reduced Costs : You can reach more consumers through the Pay app without increasing costs.

- Customer Connection : Share and create offers for customers using the business channel

- Fast Integration : Easy and fast integration with Google Pay. It takes minutes to get started.

- Security : Google has a security platform called Google Pay Shield to protect merchants and combat fraud and hacking.

- Seller support : Use the help center for support anytime, or contact Google by phone or chat.

- No additional fees : There are no additional fees to process your transactions and access the money you earn.

Whether you're a small business or a large enterprise, Google Pay offers the freedom and convenience that comes from just having a payments app that works. You can accept payments from your customers faster and contact them at your convenience.

How does Google Pay work? (For clients)

For customers, Google Pay is a solution that quickly and easily integrates with various services that users already use. Users can make in-game payments on mobile devices with a few taps and send ACH transfers to others for free using Gmail. There's also a tap-to-pay feature for phones that support Google apps.

For customers, using Google Pay is extremely easy. All you have to do is create an account and link it to your favorite bank or loan respectively. Google Pay is supported by all four major US banks. You can also set up your account with Visa, Discover, American Express and Mastercard.

Other banks and credit unions supporting the app include Barclays, Discover, American Express, US Bank and others. Google Pay users can also easily add cards and banking information to the app. Through the integration system, Google has partnered with several apps to make shopping easier for consumers.

Currently, Google Pay customers can make payments through their account in the app or online. You can also make payments using Google Pay in-store and at various leading companies such as Starbucks, Airbnb, Doordash, and Groupon.

Google Pay is currently available in 29 countries for in-app and contactless payments, as long as you use a compatible device and eligible cards. However, it's worth noting that not all Google Pay features are available in all countries.

Advertising ⓘ

Banks

At the time the application was launched in the Russian Federation, the service interacted with 14 banking institutions. Among them were Alfa-Bank, MTS Bank, VTB 24, Otkritie, Sberbank, Russian Standard and others. In parallel, the system worked with Yandex. Money. Over the past few years, the list of banks cooperating with Android Pay in Russia has increased significantly. Today it includes more than 50 financial institutions. In other words, almost all banks in the Russian Federation cooperate with Google Pay. The difference is in the type of cards supported (MasterCard, Visa, World).

By the way, all major banks support contactless payment in all possible ways. For example, you can pay from a VTB card using a QR code.

The World card can be connected to Google Pay from October 26, 2021. Banks have already begun the technical implementation of the service. Sber, Post Bank, VTB, Rosbank are the first to implement this opportunity. The world has already been connected to Apple Pay since April 2022.

How does Google Pay work? (For business)

Google Pay is a way for merchants to easily accept mobile payments from their customers for a variety of goods and services. Customers simply add their credit and debit cards to their Google Wallet. When they buy through Google Pay, the purchasing process is quick and easy. All your customers have to do is tap their device on the payment processor or use a button in the app.

Customers need to wake up their device before they can pay in-store. Some larger purchases may also require you to unlock your device. Google Pay processes transactions using debit and credit cards previously added to Google Pay. Google Pay does all the hard work without customers even having to open the app.

After completing their purchase, customers will see payment confirmation on your point-of-sale terminal and transaction details will appear on their device.

To accept Google Pay online, merchants need to configure the Google Pay API. This involves using the Google Pay for Payments API solution. You can add a button to your store that makes accepting payments easier.

Businesses using Google Pay as a transaction management method can also see sales numbers and important information at a glance on their account page.

Notably, not all features available for Google Pay will be available in every country. Some features are limited to certain areas. For example, you cannot use the train and bus payment features outside of countries such as the US, UK, Canada, Russia, Japan, Australia, Singapore and Ukraine.

System for Samsung

This system was created for Samsung smartphones. A special feature of the technology is support for payment via magnetic tape.

Instructions for adding a bank card to the application:

- Launch the program and enter your Samsung account information.

- Select the optimal authorization method (fingerprint or pin).

- Click on the “+” icon.

- Enter the card details.

- We agree to the terms.

After completing all the steps, an SMS with a code will be sent to your smartphone. This code must be entered in the appropriate field. Then you can make a payment at any retail outlet.

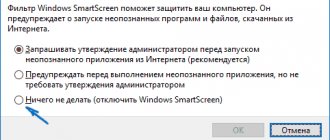

Google Pay Security

Security is one of the most important things you can consider when choosing the right merchant services or the right payment options as a consumer. Like other mobile wallets, Google Pay offers reasonable security because it doesn't send your credit card information anywhere. Instead, you receive an encrypted code that is delivered to the seller.

The code passes from the merchant to the credit card issuer, who verifies that it is correct. If you lose your phone or your device is stolen, you can delete Google Pay remotely. You can also improve your chances of protecting yourself at the checkout counter and elsewhere.

Setting unique, strong passwords for your account is a good start. Another important step is to make sure you have a screen lock on your Android or iPhone devices. You may also want to consider two-factor authentication.

Google will require you to enter a PIN for any near field communication (NFC) and debit or credit card payments. All transactions are encrypted with information that is stored in remote locations.

The biggest problem with Google Pay from a security perspective is that if you lose the password for just one service with Google, you can very easily lose control of all your accounts. You need to be especially careful about how you use your payment devices. Do not tell anyone your virtual account number.

If you lose your device, delete your payment information immediately. You can prevent Google Pay send from sending payments using Find My Device.

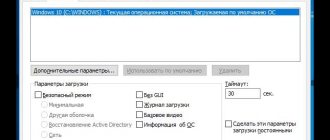

Installation: easy for some, never for others

The first thing I did useful on the morning of May 23rd was install Android Pay. Since my ZTE Axon 7 has NFC and the official firmware (despite buying the smartphone in China), there were no problems during installation and first launch.

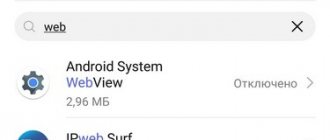

Unlike many of my friends who use “gray” devices - especially often in the Xiaomi space. A detailed experiment showed that the Android Pay app may not work in the following cases:

- using unofficial firmware (including CyanogenMod);

- use of system modifications affecting the bootloader (patches);

- using a modified bootloader (TWPR or similar);

- installing an unofficial version of the operating system (modified “firmware from the seller”);

- inability to determine location in Russia (in MIUI and some other systems).

unlocking the bootloader in the system settings (menu “For Developers”) or in another way (including official Xiaomi unlocking);

Google Pay, PayPal and Rewards

There are a few more bonuses to consider when using Google Pay. First, it's worth noting that customers can link their PayPal account to their wallet so they can pay with that method as well as with their debit or credit card. However, PayPal may sometimes ask the consumer to add funds to their account if they are running low.

While you'll have to add your card details to your Google account and select the correct checkbox for payment information every time you spend money, you don't have to enter a huge amount of detail every time. You can usually complete the payment using your fingerprint or passcode. The process is very similar to using a smartwatch for a wallet or paying Samsung.

However, whether you pay with a debit card, credit card, or PayPal, make sure the retailer you're shopping at supports Google Pay for in-store purchases. If they cannot use this wallet option in their payment terminal, they may need to request money through another payment method.

Luckily for merchants, the fact that not everyone will accept Google payments or PayPal account details for payment gives you a great way to differentiate your brand.

Another bonus Google Pay uses to keep customers happy is the ability to access loyalty programs and gift card options. You can use G Pay with gift cards and loyalty cards on iOS and Android, as long as they're accepted by the merchant.

For now, in most places and in the US, you won't be able to use an ATM with Google Pay. Instead, you may need your real card number and a physical card. However, the ability to use Android apps like Google Pay to pay with gift cards and loyalty data is a nice touch. You can use these cards at online stores like Amazon or in real life by opening the card when making a purchase.

What is an index when paying in the Play Store?

Often, when connecting a payment, people are faced with the need to enter an index. It must be indicated when a person links a bank card. This happens at the moment it is linked to the profile. You should remember certain nuances for the procedure to be successful.

Important! You will need to enter the postal code that was indicated when receiving the plastic. Otherwise, the registration will not be completed because the person will not pass the verification.

It consists of 6 digits, and in general every cardholder knows it. Sometimes there are situations when registration fails due to an incorrect index. This happens even if the person provided the data correctly. If a person does not understand what the problem is, then you can solve it as follows. It’s worth entering the index of the regional center and trying to confirm your registration again.

As a last resort, you can contact support if you cannot solve the problem yourself. It is quite possible that they will tell you what can be done in such a situation.

Pros and cons of Google Pay

Google has a lot of great products these days, from Google Chrome to G-Suite. Some people will find it very useful to use something like Google Pay to manage transactions. As a seller, this also means you'll have a new way to differentiate yourself from similar companies in the United States.

If your customers have the option to download Google Pay from the app store, they will have a different way to interact with you. On the other hand, like many other Android apps and payment methods, there is always a risk that Google Pay may not work as it should.