What is contactless payment by phone?

In simple terms, NFC (stands for Near Field Communication) is contactless payment via a mobile device, in other words, card payment via phone. This technology was introduced to the world back in 2004. It is a high-frequency connection between devices for the purpose of transferring any data.

At first glance, it is similar to Bluetooth, which is already familiar to many, but this connection is supported only within a small radius - no more than 10 cm. One of the main areas of application is paying for goods or services with a smartphone, without the need to use a bank card in the process.

How NFC works

The near-field communication module operates by induction of a magnetic field. It helps implement short-range data transmission between two devices at a frequency of slightly more than 13 MHz. When mobile phones with chips turned on are at a distance of about 10 cm, their magnetic fields interact. One sends an electric current with encoded information, the other receives it.

The module can operate in active and passive modes. In the first case, both devices have their own magnetic field, provided by their own power source. If one device does not have it, the module operates in passive mode. It works due to the magnetic field of the second. In the case of contactless payment, passive data transfer occurs.

Functions and essence of NFC

“NFC technology” in translation means communication of a nearby field. That is, two devices that support this function can communicate when they are nearby. NFC on smartphones also allows you to exchange links and files, and if you install a special application, you can create tags.

The essence of this technology is similar to Bluetooth, but NFC has several advantages. It allows you to make contactless payments and has a short range, which eliminates the possibility of interception of funds. The connection between two devices is much faster than using Bluetooth.

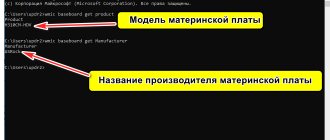

Samsung indicates NFC directly on the battery of smartphones, Sony places this information on the body of the device. But the most convenient way to check the availability of this function is through the menu. To do this you need:

- open the settings of your gadget;

- go to the wireless networks section and select “More”;

- The NFC settings item will appear here.

Security is one of the main advantages of NFC technology. Access to the device only works within a radius of 10 cm. Gadgets connect almost instantly, the only exception may be devices with different NFC locations, they will need 5-10 seconds of time. When transmitting information in this way, a minimal amount of energy is spent.

Figure 1. Finding and setting up NFC on Android.

How to enable NFC

The NFC module itself is a small chip that is placed inside the body of a smartphone or other device. Before you set up NFC, you need to check if your phone has it. There are a lot of ways to do this. The simplest one is to look at the documents or at the back side before purchasing, where the corresponding designation will be applied.

If the device has already been purchased, you can find out about the availability of the function by swiping down the top curtain. Look for a logo with an abbreviation in the list. If there is one, tap on the icon to make it bright.

You can immediately search in “Settings” - “Wireless networks / Connected devices” - “More” - NFC.” Some models have this feature enabled by default. If there is a switch opposite the corresponding function, you need to move its slider so that it becomes bright.

NFC technology or card payment via phone

In fact, the principle of operation of this technology is quite simple - the user links his bank card to a device that supports NFC and can then pay via phone.

This saves a lot of time and also eliminates the need to always carry the card with you. One of the most important characteristics of NFC is its high speed of operation - 0.1 seconds, and no additional actions are required to activate it. Simply bring your smartphone to the payment terminal and contact between the two gadgets will be established automatically.

Since the range of action of this technology is small, tablets and other large devices usually have a special sticker indicating the location of the chip.

The NFC chip has two types of operation:

- Active. Mutual file exchange mode between two devices.

- Passive. The mode of receiving or transmitting files without taking into account feedback (most often this mode is used as a travel pass or pass).

Setting examples for popular phone models

iPhone

To enable the NFC module, you need to set up Apple Pay:

- Open the Wallet app

- Touch the plus icon in the upper right corner of the screen

- Add a card by clicking “Next”

- Using an automatically turned on camera, they photograph the card so that its number is clearly visible

- indicate data from the card

- Click “Next”

- Waiting for the results of the card check. If no errors were made when entering data, the card is linked to the iPhone

Samsung

For Samsung, use the Samsung Pay application, which is preinstalled in the operating system. How to configure this application:

- Open the application, log into your Samsung account

- Set up the unlock method (PIN code or fingerprint)

- Scan a bank card or enter data manually

- Enter the verification code received on your phone

- Put your signature

Activate the application by swiping from bottom to top, select the desired card and bring the smartphone to the terminal. The advantage of Samsung Pay is that the trading terminal does not require support for NFC technology.

To use the application quickly, set the application as the default: “Settings” - “Applications” - “Advanced settings” - “Default applications (system)”. Indicates the installed utility.

Honor

The contactless payment function is supported by Honor models:

- Honor 7C

- 8A and 8X

- 9 Lite and 9

- 10 Lite, 10 and 10 Premium

- Honor Play

Pros and cons of paying by phone

The undoubted advantages of using this technology include:

- Safety. The connection between devices is established in just a split second, and the radius of influence is only a few centimeters. Thanks to this, you can, for example, pay for purchases in a store and not worry about the safety of your data.

- Convenience. The technology works in such a way that interference in the process is minimal. For example, a bank card is linked to the phone once and subsequently you do not need to enter any data for payment.

- Small size. The NFC chip is very small and does not in any way affect the size of the gadget or its weight.

- Energy saving. This chip itself does not require large amounts of energy, which means it will not significantly affect the operating time of the smartphone.

- Does not require additional payments. NFC does not have any subscription fees or other recurring charges.

- Speed of purchases. There is no need to look for a card in your bag or pockets and then enter a PIN code, which means you can make a payment a little faster.

Safety

Google is constantly monitoring the security of contactless payments. The emergence of NFC technology was caused not only by the desire to quickly pay for purchases, but also by the need for secure transactions. There is no absolutely secure payment method. But when using NFC technology, your funds are better protected than when paying with a bank card:

- The module works and receives signals at a distance of up to 10 cm, but in reality you bring the phone to the terminal at a distance of about 3 cm. Therefore, it will not be easy for attackers to read information

- When paying for a purchase or making a payment over a certain amount, you must confirm it with a password or other method

- If a phone with a chip is lost, it is more difficult for the person who found it to withdraw money than from the bank card itself. After all, you first need to gain access to the device.

Apple Pay

The system was presented to users in 2014. Over the course of its existence, the software has improved significantly, and the number of iPhones with a built-in NFC chip has increased significantly. Works on models with OS 5/5s and higher. Available in 13 countries.

Top functionality of the system

The most important functions:

- payment in stores, apps, online;

- registration of payment, gift, discount cards;

- the ability to top up bank cards of friends and relatives (currently available only in the USA);

- payment for travel in transport;

- work with NFC tags (automation of the device and other associated gadgets);

- control of other equipment (for example, a car).

Advantages and disadvantages

| Advantages | Flaws |

| There is no installation fee | Compatible with iOS devices only |

| No additional transaction fees | Limited number of partner banks |

| Intuitive interface (multiple languages) | Not all types of payment instruments are supported |

| Security: Touch ID, Face ID, Password | Registration limit (8–12) |

| Apple Watch Compatibility | Works only on contactless terminals |

| Advanced control options for paired gadgets | |

| Fast processing of transactions | |

| Does not transmit personal financial data to terminals |

Apple Pay is available through Wallet software.

Android Pay

This program for paying by phone using NFC has been in operation since 2015. Works on all devices running Android KitKat version 4.4 and higher that are equipped with NFC. By mid-2022, 15 countries of coverage have been announced and 2 are in the project at the end of the year.

Megafon Bank card - virtual and bank cards

Key functionality of Android Pay

The most popular features include:

- emulation of bank cards (Visa, MasterCard);

- registration of loyalty cards, bonus systems, transport;

- making contactless payments in supermarkets, shops, gas stations, cafes and restaurants;

- possibility of online payments (on sites where there is a special mark).

Phone owner data protection

The main question that interests many users regarding all innovations is security. Unfortunately, modern technologies are developed not only by large corporations, but also by scammers. As soon as the developers come up with something new, craftsmen immediately appear who come up with ways to bypass all the protection and withdraw money from the card. I discussed how to return stolen money and protect yourself from scammers in a separate article.

Unfortunately, the contactless form of payment has not gone unnoticed by scammers. How do they manage to withdraw money from the card? Using a special device - a reader. You need to bring it almost close to the card equipped with a chip for contactless payment, and read the information recorded there.

More than 100 cool lessons, tests and exercises for brain development

Start developing

While things are different with contactless smartphones. Payment for goods in the store is made from a virtual account through secure channels. The details of the bank card linked to the phone are not included. Access to the virtual card is protected by a password, which is unique for each transaction. A set of numbers will not tell scammers anything.

If your phone is stolen, access to the application that links your payment instruments to the device is password protected. For even greater security, block your bank cards in online banking or by calling the hotline.

Additional protection can be installed. For example, unlocking your phone using your fingerprint.

Some users are afraid that if the phone is delayed at the payment terminal, payment will go through twice. This is impossible, the transfer is carried out only once, then the device turns off.

To summarize, we can say that for now NFC technology on a smartphone is safer than paying with a bank card. Why am I saying for now? Fraudsters do not sleep. I think that the work in their extraordinary heads is in full swing. It's a question of time.

NFC Tasks Launcher

NFC Tasks Launcher is one of the most popular programs designed for these purposes. It has a rich set of settings, which allows you to solve a wide range of problems. In it, you can configure and easily switch between the “Car”, “Home” and “Office” profiles. You can place an NFC tag in your car, office, home, bedroom or living room, and the smartphone profile will automatically change and programs that you set for specific locations will be launched. The program supports NFC Forum Type 1, Type 2, Type 3 and Type 4 tags, as well as third-party tags.

Samsung Pay

Contactless payment technology operates on the principle of near-field communication and allows transactions to be processed at various types of terminals. Thanks to the application, you can quickly and comfortably pay for services and goods by holding your mobile device near the payment terminal. Save time and protect your personal information because you no longer need to remove your card from your wallet or provide other payment information. The application was specially developed for Korean brand mobile phones, so compatibility with other devices will largely depend on the region.

Visa Qiwi Walle

At the same time, Qiwi cooperates with Mastercard’s direct competitors, Visa: the partners began collaborating back in 2012, and in 2015 they launched a joint Visa PayWave application, available on smartphones with Android version no lower than 4.4.

Square Wallet

The application from a third-party developer has passed the security check of both Android and Apple. So the “square wallet” is available on almost all devices, including iPhone. This is in case someone is planning to switch to another mobile platform. You can download the NFC application to pay for purchases on your phone both on Google Play and in the AppStore.

The functionality of the application works closely with geolocation. This allows you to mark priority sellers and receive discounts for multiple purchases in the same place. True, all this is relevant only for the USA. Our service is underdeveloped. Otherwise everything is standard. You can top up the virtual balance of your wallet, or you can link a card. But, as in the case of Visa payWave, the protection of transactions and user data here is rather weak.

What services support card binding?

Having understood the essence of contactless payments, we move on to the most important thing - which banks and services support NFC. In fact, there are not so many of them, since such a function is provided only by those organizations and Internet wallets that are in great demand. And what options from these types can be seen in the table:

| Branded payment services | Third party payment services |

| Samsung Pay | Yandex.Money (YuMoney/YuMoney) |

| Google Pay | Sberbank Online |

| — | VTB Online |

| — | Qiwi Wallet |

You may be interested in: How to do a Hard Reset on Android (full reset)…

Built-in payment services

To begin with, it is recommended to devote attention to branded payment services, since they enjoy the highest percentage of demand. Among them are Samsung Pay and Google Pay. In fact, they belong to different companies, but they perform their role in approximately the same way - simply and quickly. We should start with the development from Samsung.

How to link a card to Samsung Pay

To link your card to Samsung Pay, you must first register in the system. This is easy to do and only takes a couple of minutes. And after that it is possible to use the service. Here are the instructions for linking to a smartphone with NFC:

- First you need to go to the adding section in the main screen of the program. To do this, you need to click on “+”, below which the type of payment method is indicated – “Bank card”;

- Then there can be one of two ways to develop the action - manually entering data (which takes a long time, but is accurate and without errors), surface scanning (quick, but there may be errors or not recognized by the camera). To add a card that supports contactless payments, you need to select “Add via NFC”;

- After this action, there is a point where you need to confirm the terms of work with the bank. At the bottom you need to click “Accept all”;

- After this, you need to confirm the use of the card by the application. To do this, press the “SMS (NUMBER “owner number”)” button to receive the code on the phone;

- Then, when you receive a message with the numbers required for confirmation, you need to enter them in a special field. Once this is done, the binding process can continue;

- At the end, all you have to do is add your signature so that if something happens, present it to the cashier to compare the one on the check and the one made for Samsung Pay.

You might be interested in: Dual camera on a smartphone. Why is it needed?

How to link a card to Google Pay

Users will also not have any difficulties with Google Pay. You need to follow a series of simple steps. It is similar to the previous payment option. The algorithm is as follows:

- The program where all actions will be carried out opens - Google Pay. If a person has several accounts, he needs to select the one he needs to carry out the operation;

- To quickly add a means of paying for purchases, you can swipe up from the bottom and select “Add card”;

- Next, you need to enter the data from the card manually or scan its front side using a camera. Here it is possible to use one of the options - it does not matter;

- Then you need to confirm adding to the list with payment methods. For this, as a rule, a code is used from an SMS to the owner’s number;

- Having received the number from the message, it will be possible to confirm the action and use payment from your phone in stores.

Third party payment services

It is also possible to use third-party payment services. As a rule, they are available after downloading wallet applications (Qiwi, YuMoney and others). These are also programs for managing a bank’s personal account (Sberbank, VTB and others). There are only a few of them.

Yandex money

At the moment, Yandex.Money has been renamed to YuMoney. But this does not in any way affect the performance of the program. The algorithm is almost the same, which means that no additional data or unnecessary operations will be required. Everything is just as easy to do:

- First you need to log into the application and find your account settings. The link for linking is located in the “Linked cards” block - the person clicks there for further actions in order to implement the desired simplification of payment by phone;

- First, enter the main data. They are standard for such an operation - CVV code, number, expiration date;

- This will be followed by confirmation of the action, which is performed using a one-time password. As a rule, it is issued by the bank itself to the client;

- To check the correctness of the data, the site will automatically transfer 1 ruble from the card to the user’s wallet (with a commission of 1 kopeck). If everything is correct, you will receive a notification about this action and a link will be made.

You may be interested in: What to do? The camera on your Android phone does not work.

Sberbank Online

Sberbank Online is already more popular than YuMoney. Here, their own service for working with NFC is called SberPay. And the binding algorithm here, as a rule, contains fewer actions. This is all due to the fact that you do not need to enter additional information in order to link a payment method. Here's what needs to be done:

- To begin, open the “Sberbank Online” application on your smartphone - select a card there and press the “Connect SberPay” button;

- After making your selection, you need to click on the “Connect” button;

- And at the end a screen with a check mark will appear, which means “SberPay is connected.”

VTB Online

With VTB Online, the algorithm is a little more complicated. The fact is that you need to download an additional application to pay with NFC. It’s just not possible to do this in the program through your personal account. You need additional software to work, which is available on Google Play. And after that the algorithm will go:

- After opening the application, you need to select “Add a card”;

- Next, enter the information and read it using the phone’s NFC module, which will be a simple solution;

- The easiest point is to accept the user agreement. The button below will skip this step immediately;

- And the last thing that is important to do is to receive an SMS code on your smartphone using the linked number. After the number is automatically entered (or appears in the notification, and the person enters it himself), it is possible to complete the setup and use contactless payment in stores.

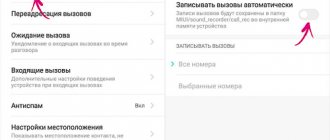

Setting up NFC for payment

How to set the settings so that you can pay with a phone with NFC without using a bank card? For smartphones running Android OS, you must first go to the main menu, then to the settings section. There select “Wireless networks”, then click “More”. If contactless payment technology is available on your mobile phone, it will be reflected in the menu. If the option is not enabled, you need to check the box next to NFC.

For gadgets from Apple, no such actions are required. You won't find an item in the menu specifically for NFC. To activate this function, you only need to install Apple Pay and register the card.

Payment for purchases via NFC

Contactless payments are one of the most convenient and widespread ways to use NFC. You need to attach a bank card to your phone, and you can make payments through any POS terminal.

To set up contactless payments you need:

- apply for a PayPass card;

- download your bank's app;

- find the NFC section in the application menu;

- attach the card to the phone cover to read it.

After this, the user will receive a message with a password for payment transactions, which must be remembered. After completing the setup, a digital copy of the card will appear in the gadget, and the user can make payments. There is an important condition - you need an Android operating system of at least 4.4. With contactless payment, the seller sees only a digital transaction code, the buyer's name and card number remain unknown.

Create NFC tags

NFC technology allows you to create and read various tags. The essence of this function is similar to the operation of a QR code, but it does not use a camera, but a small chip tag that is embedded anywhere: on labels, price tags, business cards and other items.

A tag is needed to set the device to perform certain actions: send a message or email, call a specific contact, open an application, set an alarm, etc.

To configure this function, you must:

- buy an NFC tag;

- consider it your gadget;

- enter information about what action needs to be performed;

- place the mark in any convenient place.

When the device comes within its range, it reads the task and the technology automatically starts executing it.

Loading a map into your phone

To understand how to fully configure NFC for card payments, you should install one of the payment applications - Android Pay, Samsung Pay, Apple Pay - depending on your smartphone model and preferences.

Next, if your bank card is compatible with the contactless payment system, you need to add it to the application. The card must have a paypass option and must be issued by a bank that uses NSF. Further:

- We go through identification (go to the application, enter data).

- Click the “Add new card” button.

- We enter the card data that the application requests. In some cases it is necessary to take a photo of the card.

- Select a confirmation method (for example, fingerprint).

- We complete the process.

The entered card becomes a virtual copy of the real one - it has the same balance and other data.

How to pay with a Samsung phone instead of a Sberbank card

NFC is available on Samsung models released in 2022 and later. You can assign a card to your phone using the Sberbank Online or Samsung Pay application.

Through Sberbank Online: 1. Download and install the Sberbank Online application. 2. Log in to Sberbank Online, find your card and in its description find the service for adding to Samsung Pay. 3. Automatic launch of the program (it already contains all the details). 4. Confirm registration.

Through Samsung Pay: 1. Register an account on Samsung Account. If she's not there. 2. Enter the main menu of Samsung Account, then go to card activation. 3. Write the number, the date until which the card will be valid, and the name of the owner or scan it with the phone’s video camera. 4. Confirm your agreement with the clauses of the Agreement. 5. In the settings section (phone settings), select the personalization method - pattern or fingerprint.

Card management

Any of the applications gives its users the opportunity to add multiple cards. These cards can be issued by different banks. By default, the main card for payment is the one whose data was entered first. However, this can be adjusted in the settings of the installed application.

NFC technology is simple and easy to use. Over the entire period of its existence, it has been appreciated both by the owners of modern smartphones and various commercial establishments. Contactless payment is being introduced at an accelerated pace in a variety of areas, as it allows for more positive and productive communication between companies and their customers.

How to pay by phone on Android instead of a Sberbank card

To begin, NFC is activated on your phone: 1. In the settings, go to “Connection and sharing.” 2. There is a slider near NFC; you need to move it for the module to turn on.

Adding a card: 1. Add Google Pay from the Play Store. 2. Open the installed Google Pay application, enter “Payment”. 3. Click “Payment Method”. 4. Enter the information on the front side of the card (number, expiration date). 5. Save.

If you need to confirm the card, this is done by test debiting the money.